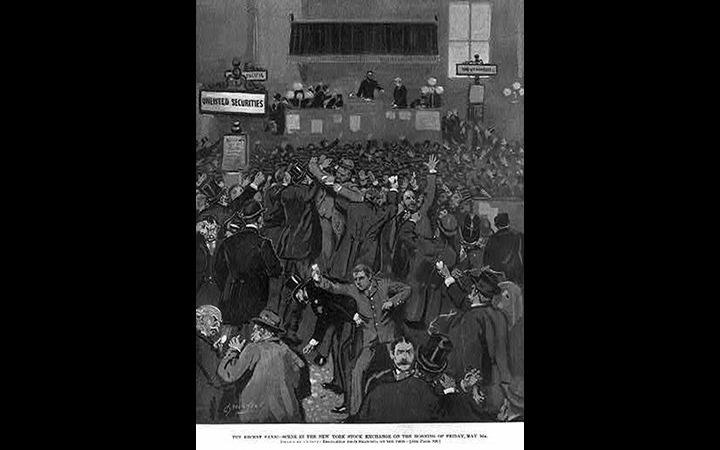

![<p>The Panic - Run on the Fourth National Bank, No. 20 Nassau Street [New York City, 1873]. (Image LC-USZ6-952 via<a href="https://www.loc.gov/pictures/resource/cph.3a00900/"> Library of Congress Prints and Photographs Division</a>)<br></p>](/-/media/Project/FedHistory/FedHistory/Images/financial-stability_720x450.jpg?h=450&iar=0&w=720&hash=AD5F52DA3FC480826735D022DD5E5EF4)

Read on

Support for Specific Institutions

The failures of Bear Stearns and Lehman Brothers and the bailout of AIG occurred in 2008

Fed Credit Programs

The Fed introduced various credit programs to deal with the 2007-09 financial crisis

The Federal Reserve's Response to the September 11 Terrorist Attacks

The 9/11 attacks created massive dislocations in US financial markets. The Fed played a leading role in responding to the immediate crisis, using the wide range of its authorities to limit the economic fallout and support the US financial system.

Near Failure of LTCM

A group of banks and brokerage firms prevented the collapse of this hedge fund in 1998

Asian Financial Crisis

A financial crisis started in Thailand in July 1997 and spread across East Asia

Crash of 1987

The Dow dropped 22.6 percent on Black Monday, October 19, 1987

Continental Illinois: A Bank That Was Too Big to Fail

The phrase "too big to fail" became commonly used for the first time after Continental's crisis

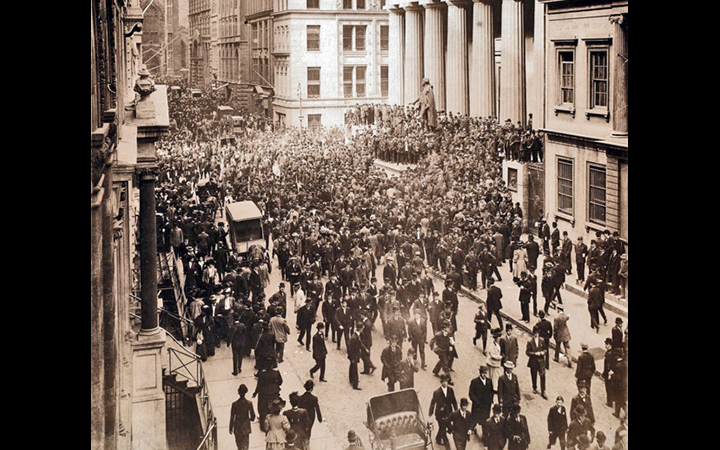

Latin American Debt Crisis

During the 1980s, many Latin American countries were unable to service their foreign debt

Savings and Loan Crisis

The 1980s was a period of distress for the financial sector, especially savings and loans

Banking Act of 1933

Commonly called Glass-Steagall, the Act was widely debated before its enactment

Emergency Banking Act

The 1933 law was aimed at restoring public confidence in the nation's financial system

Bank Holiday of 1933

For an entire week in March 1933, all banking transactions were suspended

Federal Home Loan Bank Advances

The Federal Home Loan Banks were established to advance funds to home mortgage lenders that historically did not have access to the Federal Reserve System.

Emergency Lending to Nonbank Borrowers

The Emergency Relief and Construction Act of 1932 expanded the Fed's ability to make certain loans under "unusual and exigent circumstances."

Reconstruction Finance Corporation Act

During the years 1932 and 1933, the Reconstruction Finance Corporation effectively served as the discount lending arm of the Federal Reserve Board.

Banking Panics of 1931-33

Earlier regional banking panics turned into a nationwide financial crisis in fall 1931

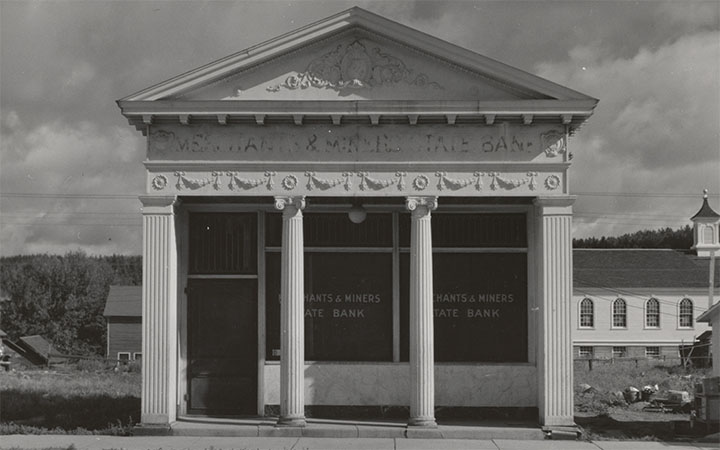

Banking Panics of 1930-31

The U.S. appeared to be poised for economic recovery when a series of bank panics began in fall 1930

Crash of 1929

On October 28, 1929, the Dow declined nearly 13 percent

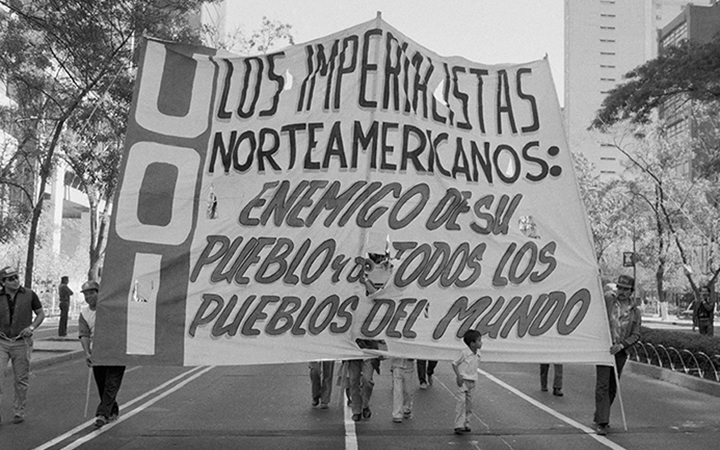

Panic of 1907

The story of the crash that inspired monetary reform

Banking Panics of the Gilded Age

The late 19th century was beset by panics