Reconstruction Finance Corporation Act

January 22, 1932

President Hoover signed the Reconstruction Finance Corporation Act on January 22, 1932, establishing the Reconstruction Finance Corporation (RFC). The subtitle of the act indicated the RFC's purpose:

"to provide emergency financing facilities for financial institutions, to aid in financing agriculture, commerce, and industry..."

The RFC was a new government-sponsored financial institution whose purpose was to lend directly to banks and other financial institutions including those without access to Federal Reserve credit facilities. "Almost from the time he became Governor of the Federal Reserve Board in September 1930, Eugene Meyer had urged President Hoover to establish" a Reconstruction Finance Corporation (RFC) modeled on the "War Finance Corporation, which Meyer had headed during World War 1" (Chandler 1971, 180). Meyer told the New York Times that the RFC "would be a strong influence in restoring confidence throughout the nation and in helping banks to resume their normal functions by relieving them of frozen assets (New York Times 1932)."

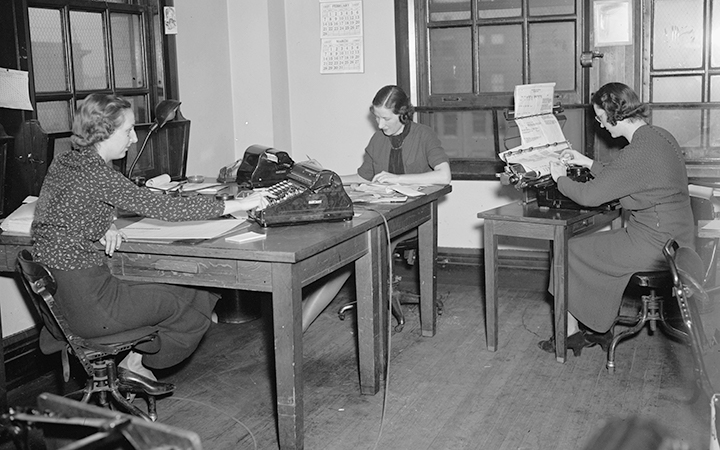

The RFC was a quasi-public corporation, staffed by professionals recruited outside of the civil service system but owned by the federal government, which appointed the corporation's executive officers and board of directors. The RFC's initial capital came from $500 million in stock sold to the US Treasury. The RFC raised an additional $1.5 billion by selling bonds to the Treasury, which the Treasury in turn sold to the public. In the years that followed, the RFC borrowed an additional $51.3 billion from the Treasury and $3.1 billion directly from the public. All of these obligations were guaranteed by the federal government.

The RFC was authorized to extend loans to all financial institutions in the United States and to accept as collateral any asset the RFC's leaders deemed acceptable.1 The RFC's mandate emphasized loaning funds to solvent but illiquid institutions whose assets appeared to have sufficient long-term value to pay all creditors but in the short run could not be sold at a price high enough to repay current obligations. The RFC also loaned funds to the receivers of banks in liquidation enabling receivers to repay depositors as soon as possible; Federal Land Banks, which financed farm mortgages; and Federal Intermediate Credit Banks, which financed crops in production; insurance companies; and railroads.

On July 21, 1932, an amendment authorized the RFC to loan funds to state and municipal governments. The loans could finance infrastructure projects, such as the construction of dams and bridges, whose construction costs would be repaid by user fees and tolls. The loans could also fund relief for the unemployed, as long as repayment was guaranteed by tax receipts. In March 1933 the powers of the RFC were liberalized still further to include authority to recapitalize banks through purchases of preferred stock.

In December 1931, the Hoover administration submitted the Reconstruction Finance Corporation Act to Congress. Congress expedited the legislation. Support for the act was broad and bipartisan. The president and Federal Reserve Board urged approval. So did leaders of the banking and business communities. The bill passed quickly and with few amendments, in part because it was based on the War Finance Corporation of World War 1, which policymakers believed to have been a big success.

During the years 1932 and 1933, the Reconstruction Finance Corporation served, in effect, as the discount lending arm of the Federal Reserve Board. The governor of the Federal Reserve Board, Eugene Meyer, lobbied for the creation of the RFC, helped to recruit its initial staff, contributed to the design of its structure and policies, supervised its operation, and served as the chairman of its board. The RFC occupied office space in the same building as the Federal Reserve Board. In 1933, after Eugene Meyer resigned from both institutions and the Roosevelt administration appointed different men to lead the RFC and the Fed, the organizations diverged, with the RFC remaining within the executive branch and the Federal Reserve gradually regaining its policy independence.

In retrospect, scholars see the Reconstruction Finance Corporation as mostly successful, particularly in the period when the RFC was able to accept less liquid collateral and recapitalize banks. While estimates vary, statistical analyses show that RFC assistance helped banks survive the Depression and increased bank lending (Butkiewicz 1995; Mason 2001; Mason 2003; Vossmeyer 2016). More than half of the banks in the U.S. received direct support from the RFC (Jones 1951). However, its success was limited, as some banks that received RFC support did not survive the Depression.

Endnotes

- 1 Initially, the rates, terms and collateral for RFC loans were the same as those for Federal Reserve discount loans to member banks. Collateral requirements for RFC loans were eased beginning in July 1932.

Bibliography

Butkiewicz, James L. "The Impact of a Lender of Last Resort During the Great Depression: the Case of the Reconstruction Finance Corporation." Explorations in Economic History 32, no. 2 (April 1995): 197-216.

Chandler, Lester V. American Monetary Policy, 1928 to 1941. New York: Harper and Row, 1971.

Crum, W. L. and J.B. Hubbard. "Review of the First Quarter of 1932." Review of Economics and Statistics 14, no. 2 (May 1932): 66-73.

Ebersole, J. Franklin. "One Year of the Reconstruction Finance Corporation." Quarterly Journal of Economics 47, no. 3 (May 1933): 464-92.

Friedman, Milton and Anna Schwartz. A Monetary History of the United States: 1867-1960. Princeton: Princeton University Press, 1963.

Harris, S.E.. "Banking and Currency Legislation, 1932." Quarterly Journal of Economics 46, no. 3 (May 1932): 546-57.

Hoover, Herbert. The Memoirs of Herbert Hoover: The Great Depression, 1929 to 1941. New York: Macmillan Company, 1952, p. 117.

Jones, Jesse H. Fifty Billion Dollars: My Thirteen Years with the RFC (1932-1934). New York: Macmillan Company, 1951.

Mason, Joseph. "The Political Economy of RFC Assistance during the Great Depression." Explorations in Economic History 40, no. 2 (April 2003): 101-21.

Mason, Joseph. "Do Lender of Last Resort Policies Matter? The Effects of Reconstruction Finance Corporation Assistance to Banks During the Great Depression." Journal of Financial Services Research 20, no. 1 (September 2001): 77-95.

Meltzer, Allan. A History of the Federal Reserve: Volume 1, 1913 to 1951. Chicago: University of Chicago Press, 2003.&

New York Times. "Hearings Are Begun On Credit Pool Bill." December 19, 1931.

New York Times. "The Finance Corporation's Program." February 10, 1932.

Vossmeyer, Angela. "Sample Selection and Treatment Effect Estimation of Lender of Last Resort Policies." Journal of Business and Economic Statistics 34, no 2 (2016): 197-212.

Written as of November 22, 2013 as part of the essay "Banking Acts of 1932" and revised by David C. Wheelock as of January 2022. See disclaimer and update policy.

X

X  facebook

facebook

email

email