One part of the Fed's dual mandate is price stability. Price stability means that inflation remains low and stable over the longer run.

Fed’s Anti-Inflation Actions

In 1979, Fed Chairman Paul Volcker announced new anti-inflation measures

Oil Shock of 1978-79

The second oil shock of the 1970s was associated with events in the Middle East

Oil Shock of 1973-74

An oil embargo in the early 1970s complicated the U.S. macroeconomic environment

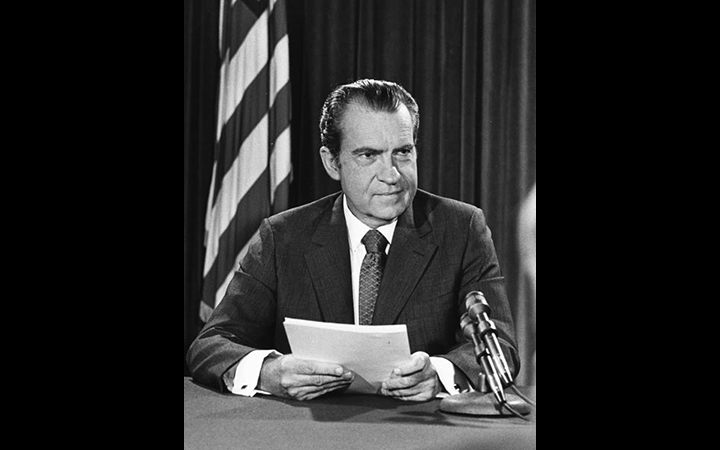

Gold Convertibility Ends

President Nixon's 1971 economic plan, sometimes referred to as "Nixonomics," ended gold convertibility and imposed wage and price controls

![Close-up of a "Whip Inflation Now" [WIN] button, President Ford's symbol of the fight against inflation.](/-/media/images/great_inflation_1_720x450.jpg)

Great Inflation

The defining macroeconomic period of the second half of the 20th century lasted from 1965 to 1982

Roosevelt’s Gold Program

The controversial and consequential policies of FDR regarding gold and dollars