The Panic of 1907

1907

The Panic of 1907 was the first worldwide financial crisis of the twentieth century. It transformed a recession into a contraction surpassed in severity only by the Great Depression.1 The panic's impact is still felt today because it spurred the monetary reform movement that led to the establishment of the Federal Reserve System. Moen and Tallman (1999) argued that the experience of the Panic of 1907 changed how New York Clearing House bankers perceived the value of a central bank because the panic took hold mainly among trust companies, institutions outside their membership.

The central role of New York City trust companies distinguishes the Panic of 1907 from earlier panics. Trust companies were state-chartered intermediaries that competed with banks for deposits. Trusts were not, however, a central part of the payments system and had a low volume of check clearing compared with banks. As a result, they held a low percentage of cash reserves relative to deposits, around 5 percent, compared with 25 percent for national banks. Because trust-company deposit accounts were demandable in cash, trusts were just as susceptible to runs on deposits as were banks.

Despite their minor role in the payments system, trusts were large and important to the financial system. Trust companies loaned large sums directly in New York equity markets, including New York Stock Exchange brokers. Trusts did not require collateral for these loans, which had to be repaid by the end of the business day. Brokers used these loans to purchase securities for themselves or their clients and then used these securities as collateral for a call loan—an overnight loan that facilitated stock purchases—from a nationally chartered bank.2 The proceeds of the call loan were used to pay back the initial loan from the trust company. Trusts were a necessary part of this process, because the law prohibited nationally chartered commercial banks from making uncollateralized loans or guaranteeing the payment of checks written by brokers on accounts without sufficient funds.3 The extra liquidity provided by trusts supported new daily transactions on the floor of the exchange. Runs on trust company deposits, however, short-circuited their role as the initial liquidity provider to the stock market.

The Panic of 1907 had many elements in common with the financial crisis of 2007-09.4 Both crises started among New York City financial institutions and markets, and both affected the economy of the United States and the rest of the world. Examining the sequence of events in 1907 makes the parallels clear.

On October 16, 1907, two minor speculators, F. Augustus Heinze and Charles W. Morse, suffered huge losses in a failed attempt to corner the stock of United Copper, a copper mining company traded on the curb.5,6 After the collapse of this corner, the banks associated with these men succumbed to runs by depositors, who moved their deposits from dubious Heinze banks toward more reliable banks.

Four days later, the New York Clearing House made a public announcement that the Heinze-related member banks like Mercantile National Bank had been examined and deemed to be solvent, calming their depositors. The Clearing House also forced out the management of these banks, including Heinze and Morse. The New York Clearing House then offered these banks loans that were eventually exchanged for clearing house loan certificates, one of the benefits of membership in the Clearing House Association.7

While the Clearing House had been able to quash the runs on the national banks associated with Heinze and Morse, they were spreading to the trust companies. On Friday, October 18, news broke that the president of Knickerbocker Trust, Charles T. Barney, was an associate of Morse.8 The news sparked a run on Knickerbocker. The National Bank of Commerce extended credit to Knickerbocker Trust to cover those withdrawals.

The bank then requested a loan from the New York Clearing House on the behalf of Knickerbocker Trust on Monday, October 21. The Clearing House denied the request because its resources were reserved for the support of its member institutions. Knickerbocker and most other trust companies in New York were not members. After this denial, a request for aid was made to J.P. Morgan. He asked Benjamin Strong, then a vice president at Banker's Trust and later the first head of the Federal Reserve Bank of New York, to examine Knickerbocker's books and determine its financial condition. In the short period of time available, Strong could make no definitive determination of Knickerbocker's solvency.9 Morgan therefore refused to aid the trust.

Also on October 21, Knickerbocker's Board of Directors dismissed Barney on the basis of his personal connections to Morse.10 The National Bank of Commerce then announced that it would no longer act as Knickerbocker's clearing agent. Following these announcements, the run on Knickerbocker intensified. The next day, after depositors had withdrawn nearly $8 million, it suspended operations.

The suspension of Knickerbocker Trust sparked the full-scale financial crisis in New York City. The runs on deposits spread among the trusts and were most intense at the Trust Company of America. Morgan changed his mind and quickly released aid, as did the New York Clearing House banks. However, depositors continued to withdraw funds from Trust Company of America for two more weeks.

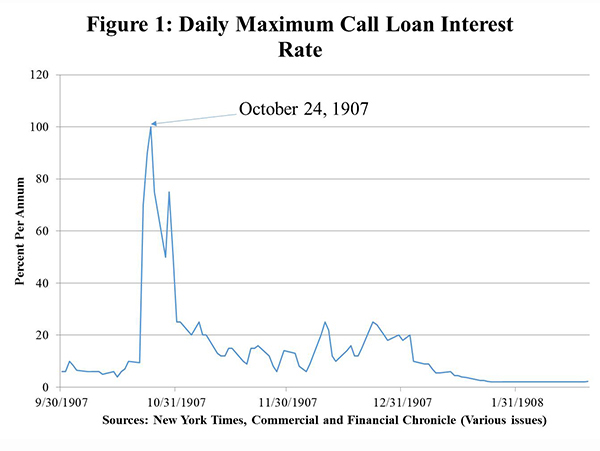

An upward spike in the call money interest rate—the rate of interest on overnight loans on stock collateral offered at the New York Stock Exchange—was among the first signals of distress and tightening credit (see Figure 1). On the day Knickerbocker closed, October 22, the annualized rate jumped from 9.5 percent to 70 percent, then to 100 percent two days later. At times, there were no credit offers at that rate. The New York Stock Exchange remained open largely because of the legendary actions of Morgan, who solicited cash from large financial and industrial institutions and then had it delivered directly to the loan post at the exchange to support brokers who were willing to extend credit.

After an unusual delay of five days, the New York Clearing House Committee met on Saturday, October 26, and formed a panel to facilitate the issuance of clearing-house loan certificates.11 These were the predecessor to discount window loans from the Federal Reserve System and provided a temporary increase in liquidity. On the same day, the New York Clearing House banks—those institutions central to the payment system—chose to restrict the convertibility of deposits into cash.12 This action severed the par exchange rate between deposits and cash, thereby leading to a cash premium and a substantial influx of gold imports from abroad. Those gold imports appear to have been instrumental in spurring the recovery of the New York City financial market.13

The parallels between the crises in 1907 and 2008 are striking. During 2007-09, the financial crisis was centered on investment banks, institutions without direct access to the Federal Reserve System. In 1907, widespread depositor withdrawals occurred at New York City trust companies—intermediaries outside the New York Clearing House, the effective lender of last resort. In effect, both financial crises started outside the large banks serving as payments centers. Yet the crises created havoc within markets and among banks that were central to the payments system. Both crises challenged the existing mechanisms used to alleviate crises.

The trust companies in 1907 were like the shadow banks in the financial crisis of 2007-09. Short-term lending during the recent crisis came largely from some shadow banks (hedge funds and money market mutual funds) to fund other shadow banks (investment banks). As key liquidity providers for repurchase agreements, these shadow banks were the "depositors" providing funds for overnight lending to allow investment banks to finance the asset-backed security market, just as uncollateralized loans (overdrafts) by trust companies allowed brokers to purchase stock.14 Both the trusts and the shadow banks faced runs by their depositors and had to withdraw lending in short-term credit markets.

Endnotes

- 1 See Frydman, Hilt, and Zhou (2015) for empirical evidence in support of this view.

- 2 National banks required collateral to offer call loans to brokers/borrowers. Borrowers, however, needed loans to buy collateral before getting the call loan from the bank.

- 3 Sereno Pratt (1904, 183) explains the sequence of transactions in detail. Note that a "daylight" loan with maturity of one day is financing a security (stock security) with no effective maturity, illustrating a maturity mismatch that typically had small risk because it was repaid by the end of the day (normally).

- 4 See Frydman, Hilt, and Zhou (2015), Gorton and Tallman (2015), Moen and Tallman (2015), and Fohlin, Gehrig, and Haas (2015).

- 5 Philip Woods provides a detailed description of the background behind the speculative endeavors of Heinze and Morse here. Note, however, that there are factual errors regarding the failures. For example, Knickerbocker Trust reopened in March 1908 after a capital infusion of $2.4 million.

- 6 See Bruner and Carr (2007) and Tallman and Moen (1990) for an event summary. Frydman, Hilt, and Zhou (2015) and Tallman (2013) highlight recent research and discoveries.

- 7 See Moen and Tallman (2000) for evidence regarding the benefits of clearinghouse membership during the panic.

- 8 Frydman, Hilt, and Zhou (2015), and Fohlin, Gehrig, and Haas (2015), suggest that the Panic of 1907 resulted largely from rumor.

- 9 Chandler (1958, 28) notes that Knickerbocker Trust had run out of cash and closed its doors before a "cursory" examination of its books could be completed.

- 10 Barney committed suicide on November 14, 1907.

- 11 See Tallman (2013, 58) for a detailed explanation of clearing house loan certificates as they were used in the National Banking era crises. See Moen and Tallman (2015) for an empirical analysis of the actual issues by the New York Clearing House from 1873 to 1908.

- 12 Trust companies did not restrict the convertibility of deposits into cash at any point during the panic. It is possible that such an action, if coordinated and supported, could have reduced the massive withdrawal of over 36 percent of deposits from New York City trust companies between August 22 and December 19, 1907. Deposits at New York City national banks actually increased during that period.

- 13 See Gorton and Tallman (2015) for a discussion of the role of gold inflows during the panics in 1893 and 1907. See also Odell and Weidenmier (2004), Rodgers and Payne (2014), and Rodgers and Wilson (2011).

- 14 See Gorton (2010, 2012) for the full description of his approach to financial crises. The discussion above is our adaptation of those arguments.

- 15 See Frydman, Hilt, and Zhou (2015). For comparable evidence for the modern instance of 2007-09, see Chodorow-Reich (2014).

- 16 Tallman (2013).

- 17 See Jalil (2015) for comparisons of all financial panics in the US after 1821.

- 18 National banks are still regulated by the Office of the Comptroller of the Currency, a bureau of the US Department of the Treasury. The regulatory structure was not designed to intervene during crisis. Interventions by the US Treasury, however, took place in several pre-Fed panics. The Treasury was not guided by explicit regulation. Rather, it was guided by the intuition of the current secretary of the Treasury, most notably Leslie Shaw. See Taus (1943) and Timberlake (1993).

Bibliography

Bernanke, Ben S. "Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression." American Economic Review 73, no. 3 (June 1983): 257-76.

Bruner, Robert F., and Sean D. Carr. The Panic of 1907: Lessons Learned from the Market's Perfect Storm. New York: Wiley, 2007.

Chandler, Lester V. Benjamin Strong, Central Banker. Washington DC: Brookings Institution, Faber and Faber, Ltd., 1958.

Chodorow-Reich, Gabriel. "The Employment Effects of Credit Market Disruptions: Firm-Level Evidence from the 2008-09 Financial Crisis." Quarterly Journal of Economics 129, no. 1 (February 2014): 1-59.

Fohlin, Caroline, Thomas Gehrig, and Marlene Haas. "Rumors and Runs in Opaque Markets: Evidence from the Panic of 1907." Unpublished manuscript, 2015. Available online.

Frydman, Carola, Eric Hilt, and Lily Y. Zhou. "Economic Effects of Runs on Early 'Shadow Banks': Trust Companies and the Impact of the Panic of 1907." Journal of Political Economy 123, no. 4 (August 2015), 902-40.

Gorton, Gary B. Slapped by the Invisible Hand: The Panic of 2007. New York: Oxford University Press, 2010.

Gorton, Gary B. Misunderstanding Financial Crises. New York: Oxford University Press, 2012.

Gorton, Gary B., and Ellis W. Tallman. "How Did Pre-Fed Banking Panics End?" NBER Working Paper 22036, February 2016. Available online.

Jalil, Andrew J. "A New History of Banking Panics in the United States, 1825-1929: Construction and Implications." American Economic Journal: Macroeconomics 7, no. 3 (July 2015): 295-330.

Moen, Jon R., and Ellis W. Tallman. "The Bank Panic of 1907: the Role of Trust Companies." Journal of Economic History 52, no. 3 (September 1992): 611-30.

Moen, Jon R., and Ellis W. Tallman. "Why Didn't the United States Establish a Central Bank until after the Panic of 1907?" Federal Reserve Bank of Atlanta Working Paper No. 99-16, November 1999. Available on FRASER.

Moen, Jon R., and Ellis W. Tallman. "Clearinghouse Membership and Deposit Contraction during the Panic of 1907." Journal of Economic History 60, no. 1 (March 2000): 145-63.

Moen, Jon R., and Ellis W. Tallman, "Close but not a Central Bank: The New York Clearing House and Issues of Clearing House Loan Certificates," in Current Federal Reserve Policy Under the Lens of Economic History. Ed., Owen Humpage, New York: Cambridge University Press, 2015.

Odell, Kerry A., and Marc D. Weidenmier. "Real Shock, Monetary Aftershock: The 1906 San Francisco Earthquake and the Panic of 1907." Journal of Economic History 64, no. 4 (December 2004): 1002-27.

Pratt, Sereno. The Work of Wall Street, New York: Appleton and Co., 1904.

Rodgers, Mary Tone, and James E. Payne. "How the Bank of France Changed U.S. Equity Expectations and Ended the Panic of 1907." Journal of Economic History 74, no. 2 (June 2014): 420-48.

Rodgers Mary Tone, and Berry K. Wilson. "Systemic Risk, Missing Gold Flows, and the Panic of 1907." Quarterly Journal of Austrian Economics 14, no. 2 (Summer 2011): 158-87.

Tallman, Ellis W., "The Panic of 1907," in The Handbook of Major Events in Economic History, Chapter 6. Ed., Randall E. Parker and Robert Whaples, New York: Routledge, 2013.

Tallman, Ellis W., and Jon R. Moen. "Lessons from the Panic of 1907." Federal Reserve Bank of Atlanta Economic Review 75 (May/June): 2-13.

Taus, Esther R. Central Banking Functions of the United States Treasury: 1789-1941. New York: Columbia University Press, 1943.

Timberlake, Richard H. Monetary Policy in the United States: An Intellectual and Institutional History. Chicago: University of Chicago Press, 1993.

Woods, Philip. "The Bank Panic of October 1907 - A Spectator's View." New York Society of Security Analysts, June 6, 2011. Available online via the Internet Archive's Wayback Machine.

Written as of December 4, 2015. See disclaimer and update policy.

X

X  facebook

facebook

email

email