Community Reinvestment Act of 1977

October 12, 1977

The 1977 Community Reinvestment Act (CRA) is a seminal piece of legislation intended to address inequities in access to credit. Discrimination in real estate and lending, including race-based redlining, had become illegal at the federal level under the 1968 Fair Housing Act. Yet, many community groups and policymakers remained concerned that the practice of redlining lingered and neighborhoods suffered for lack of investment. Previous civil rights laws focused on what lenders should not do, but the CRA focused on what lenders should do: reinvest in the communities where they operate, including low- and moderate-income communities, consistent with safe and sound operation.

Federal banking agencies, including the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation, implement the CRA and review the lending practices of banks to determine whether they meet their CRA obligations. Over time, the agencies have updated the implementation of the CRA, but the regulations have not been substantially updated since 1995. In 2022, the agencies issued a notice of proposed rulemaking to strengthen and modernize the CRA regulations. This proposal asked for external stakeholder feedback on a series of proposed updates intended to adapt CRA regulations to major changes in the financial sector that have occurred over time, increase the consistency and transparency of CRA evaluations, and tailor CRA evaluations and data collection to bank size and type.

The Push for the CRA

The CRA was passed after a history of urban areas being subjected to systematic disinvestment—the deprival of investment and access to credit. Many consumer and community organizations focused in particular on addressing redlining in the residential mortgage market, a practice in which lenders provided unequal credit access or terms based on where people lived.

Though racially motivated redlining was banned by the 1968 Fair Housing Act, community groups (such as the New York Public Interest Research Group, pictured) were still uncovering evidence in the mid-1970s of what they saw as continuation of the practice. Analysis of this kind made use of data disclosed through the Home Mortgage Disclosure Act, passed in 1975, and similar laws at the state level. Until such disclosures became available, mapping a lender's mortgage loans had been highly time consuming, typically requiring many hours by volunteers in county government buildings to sift through mortgage records.1 Instead, community groups began receiving information tabulated by zip code or census tract directly from lenders. Activists in Chicago, for example, found that six local lenders had made 75 percent of their conventional residential mortgage loans in the suburbs in 1975, and only 22 percent in the city.2 Lenders strongly contested whether simple statistics of this kind provided compelling evidence of discrimination.

Many lenders also argued that they were meeting community credit needs, viewing instead that statistics such as those produced for Chicago were the result of low demand for loans in urban neighborhoods. For example, the president of the American Bankers Association spoke of communities that had "no current need for funds that were being channeled into other communities."3 Activists responded that redlining itself depressed demand for loans in urban areas by discouraging urban development while encouraging it in the suburbs.

Ultimately, Congress agreed that new legislation was needed to address lingering redlining and disinvestment. "The data provided by that [Home Mortgage Disclosure] act remove any doubt that redlining indeed exists, that many creditworthy areas are denied loans," noted Senator William Proxmire, a key author of the CRA.4

The CRA was a controversial piece of legislation. At least two major concerns were expressed by lenders and regulators prior to its passage. First, lenders suggested that other tools might more effectively promote access to credit, including the removal of interstate branching restrictions that were still widespread in the 1970s. Some regulators expressed similar views. For example, Fed Chairman Arthur Burns testified, "The Board believes that improvements in the allocation of credit are more likely to be achieved by removing existing legal and regulatory impediments to the free flow of funds in markets than by adding new ones."5 Second, lenders and regulators also voiced concern that interfering with this free flow of funds could lead to a centrally planned financial system rather than a market-based one. For their part, urban community groups noted that their neighborhoods were not in remote areas far flung from financial centers, where access to loans historically was poor, but instead sat at the center of large and prosperous metropolitan areas.

In making their case for legislation, reformers also appealed to civic concepts of fairness and public obligation. For example, Gale Cincotta, head of the Chicago-based National Training and Information Center, said "all we are asking for is a fair return on our savings into our communities."6 Cincotta was a key figure in the national movement that led to the CRA. Similarly, Senator Jake Garn observed that lenders "are chartered by the Government to provide both a safe place for the small investor's dollar as well as a source of financing for the homeowner" and "owe an obligation to serve equally both of these constituents" though he voted against the CRA.7 Reformers argued that banks and thrifts received benefits from federal deposit insurance and therefore had obligations in return. They invoked the concept of "the convenience and needs of the community to be served by the bank" that the Banking Act of 1935 set out as a factor determining whether banks should receive deposit insurance.8

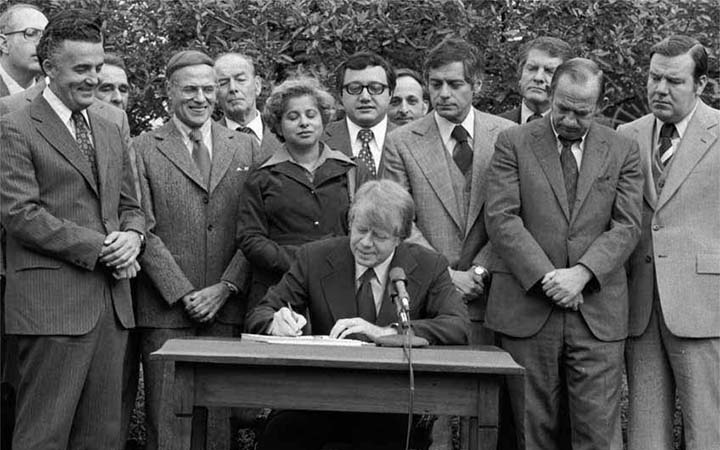

After much debate, President Carter signed the CRA into law in October 1977.

Impacts of the CRA

The immediate impact of the CRA was to contribute to pressure on lenders to assess the credit needs of low- and moderate-income (LMI) communities in a serious manner and to end redlining. The CRA effected change in concert with other laws (the Fair Housing Act, Equal Credit Opportunity Act, and Home Mortgage Disclosure Act) and a broader societal shift amid the civil rights movement. For example, lenders took steps to evaluate gaps in credit supply, established special programs and products, retrained staff, and updated their approaches over time in response to feedback from community groups and regulators.9 In many cases, lenders moved from adversarial relationships with community groups to cooperation in pursuit of mutual goals.10 The CRA also provided the public with the ability to file protests or comments if they found lenders' practices to be inadequate. To improve public accountability of this kind, Congress amended the CRA in 1989 to provide for the public disclosure of lenders' CRA ratings and performance evaluations.

In 2019, Federal Reserve Board Vice Chair Lael Brainard observed that "the CRA continues to animate a vibrant community development ecosystem connecting community members with the banks that lend and invest, community organizations that deliver services and develop housing, and state and local governments that direct incentives and subsidies."11 Federal Reserve Board Governor Ned Gramlich illustrated the prototypical CRA project in a 1999 speech:[T]he prototype CRA project features a community group supplying the entrepreneurship and organizational capability. This group may procure some cheap vacant land from the city, obtain other grants or funds for construction or rehabilitation of housing units, and then sell the units to lower-income homeowners. The mortgages on the properties will be made by banks or savings and loan associations, which get CRA credit for these loans. The community group will take funds from the sale of the new homes and roll them over into a revolving loan fund.12

The Federal Reserve has helped foster these connections between lenders and community groups through its community development (CD) function. The initial activities of the CD function focused on facilitating compliance with the CRA. Today that function promotes economic growth and financial stability for LMI households and communities by studying what works and sharing practice-informed research with lenders and community groups.

Many scholars have attempted to discern the precise quantitative impact of the CRA on lending and other activities in LMI communities over the past several decades. For example, a survey of lenders in 1999 showed that the "majority of surveyed institutions engaged in some lending activities that they would not otherwise have done" without CRA-related guidance."13 Researchers have also carefully compared how lenders' activities change depending on whether neighborhoods are designated as LMI or not. These types of narrow but precise comparisons tend to have found evidence for a small amount of CRA-induced lending, branching, and other activities.14

Conceptually, the CRA may lead to increased lending to LMI communities in a few ways. The CRA may cause the cost of serving LMI communities to fall over time as lenders' information, connections, and experience grow. The CRA may have helped reduce the occurrence of discrimination. The CRA could have broader impacts if it catalyzes activity in an area experiencing disinvestment. Former Fed Chair Ben Bernanke offered this interpretation in 2007: "At its most successful, the CRA may have had a multiplier effect, supplementing its direct impact by stimulating new market-based, profit-driven economic activity in lower-income neighborhoods."15

In considering the CRA's impact on lending, critics have charged that the Act may have contributed to the 2007-2009 financial crisis by encouraging lenders to make loans to relatively risky borrowers. The Federal Reserve Board has concluded otherwise, noting that the language of the CRA and its enforcement did not encourage excessively risky loans; that only a small portion of subprime mortgage originations at the height of the subprime boom could reasonably be linked to the CRA; and that mortgage defaults were severe even in middle- and higher-income areas, which are not the focus of the CRA.16 Likewise, the Financial Crisis Inquiry Commission concluded "the CRA was not a significant factor in subprime lending or the crisis."17Implementation of the CRA by the Federal Reserve and Other Regulators

As previously noted, the CRA is implemented today by the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation.18 Under the CRA, these agencies encourage lenders to help meet local credit needs in a manner consistent with safe and sound operation and assess lenders' records of doing so. Regulators also are required to take those records into account when assessing applications for mergers or other deposit facility changes. The CRA statute left the details of that implementation for federal banking agencies to develop.

Initially, regulators' implementation largely focused on lending policies and processes, such as how lenders marketed their services to their communities, or evidence of any practices that were discriminatory or that discouraged relevant types of lending.

Regulators have updated this implementation over the years, noting the flexibility of the CRA's statute. Each of these updates has been intended to improve the CRA's effectiveness in promoting the economic outcomes for lower-income communities while tailoring compliance requirements and responding to other criticisms or concerns. The updates have also adapted the CRA to reflect changes in the financial sector. Indeed, when the CRA was passed, lenders were more likely to be local (not national) institutions and rarely branched across state lines. Savings and loans had not yet been decimated by the Savings and Loan Crisis. And lenders interacted with borrowers largely in person, not through the internet.

In 1995, regulators overhauled CRA implementation to make it more quantitative and performance-focused, among other changes. This update also tailored the compliance burden by establishing different tests for different institutions according to size and type. An additional update in 2005 further reduced compliance for small- and intermediate-sized institutions and expanded the set of activities that are considered community development.

In 2022, the agencies proposed a significant update to the implementation of the CRA. This proposal had several key elements. It aims to expand access to credit, investment, and basic banking services in LMI communities. It seeks to adapt to changes in the banking industry, including internet and mobile banking, by updating assessment areas. It would provide greater clarity, consistency, and transparency by adopting a metrics-based approach to CRA evaluations and clarifying eligible CRA activities. Finally, it proposes to further tailor CRA evaluations and data collection to bank size and type. As of this writing, the agencies are currently evaluating the comments submitted in response to the Notice of Proposed Rulemaking as they work jointly on a CRA final rule.19

Conclusion

The CRA has promoted the development of low- and moderate-income communities since its passage in 1977. At the same time, the lack of investment that many communities had experienced has continued to impact those communities and their residents, and disparities such as the racial wealth gap and neighborhood-level differences in homeownership have persisted. These disparities indicate the continued importance of effectively promoting financial inclusion through tools such as the CRA.

Endnotes

- 1 Alane K. Sullivan and Randall J. Pozdena. "Enforcing Anti-Redlining Policy Under the Community Reinvestment Act." Federal Reserve Bank of San Francisco Economic Review, Spring 1982: 27.

- 2 Gale Cincotta. "Statement of Gale Cinotta, Chairperson, National People's Action" in U.S. Congress. Senate. Committee on Banking, Housing, and Urban Affairs. Community Credit Needs: Hearings on S. 406, March 23, 24, and 25, 1977: 132-147.

- 3 A. A. Milligan. "Prepared Statement of A. A. Milligan on Behalf of the American Bankers Association" in U.S. Congress. Senate. Committee on Banking, Housing, and Urban Affairs. Community Credit Needs: Hearings on S. 406, March 23, 24, and 25, 1977: 315.

- 4 U.S. Congress. Congressional Record, 95th Congress, 1st Session, 1977. Vol. 123, pt. 14: p. 17630.

- 5Arthur F. Burns. "Statement of Arthur F. Burns" in U.S. Congress. Senate. Committee on Banking, Housing, and Urban Affairs. Community Credit Needs: Hearings on S. 406, March 23, 24, and 25, 1977: 14

- 6 William E. Farrell. "Homeowners Ask "Redlining" Curb." New York Times, May 6, 1975.

- 7 U.S. Congress. Senate. Committee on Banking, Housing and Urban Affairs. Home Mortgage Disclosure Act of 1975: Hearings before the Committee on Banking, Housing and Urban Affairs. 94th Congress, 1st Session, May 5-8, 1975: 4.

- 8 Banking Act of 1935, Public Law 74-305, 74th Congress, H.R. 7617, August 23, 1935.

- 9 Robert B. Avery, Paul S. Calem, and Glenn B. Canner. "The Effects of the Community Reinvestment Act on Local Communities." Board of Governors of the Federal Reserve System working paper, May 20, 2003.

- 10 Griffith L. Garwood and Dolores S. Smith. "The Community Reinvestment Act: Evolution and Current Issues." Federal Reserve Bulletin, April 1993.

- 11 Lael Brainard. "The Community Reinvestment Act: How Can We Preserve What Works and Make it Better?" Speech at the 2019 Just Economy Conference, National Community Reinvestment Coalition, Washington, D.C., March 12, 2019.

- 12 Edward Gramlich. "A Policy in Lampman's Tradition: The Community Reinvestment Act." Remarks at the second annual Robert J. Lampman Memorial Lecture, University of Wisconsin, Madison, June 16, 1999.

- 13 Robert Avery, Raphael Bostic, and Glenn Canner. "Assessing the Necessity and Efficiency of the Community Reinvestment Act." Housing Policy Debate 16, no 1, 2005.

- 14 For an overview of this literature, see Kenneth Brevoort. "Does Giving CRA Credit for Loan Purchases Increase Mortgage Credit in Low-to-Moderate Income Communities?" Working Paper, Board of Governors of the Federal Reserve System Finance and Economics Discussion Series working paper no. 2022-047, June 7, 2022.

- 15 Ben S. Bernanke. The Community Reinvestment Act: Its Evolution and New Challenges. Speech at the Community Affairs Research Conference, Washington, D.C., March 30, 2007.

- 16 Board of Governors of the Federal Reserve System. Ninety-Sixth Annual Report, 2009.

- 17 Financial Crisis Inquiry Commission. The Financial Crisis Inquiry Report. January 2011.

- 18 The Federal Home Loan Bank Board and its successor, the Office of Thrift Supervision, once also implemented the CRA as it related to federally regulated savings and loans. The Dodd-Frank Act merged the Office of Thrift Supervision into the Office of the Comptroller of the Currency.

- 19 The Board's website on the proposed rulemaking can be found at this link: https://www.federalreserve.gov/consumerscommunities/community-reinvestment-act-proposed-rulemaking.htm

- 20 Lael Brainard. "Strengthening the CRA to Meet the Challenges of Our Time." Speech at the Urban Institute, Washington, D.C. (via webcast), September 21, 2020.

This edition written as of May 8, 2023. Jonathan Rose contributed to this article. Please cite this essay as: Federal Reserve History. "Community Reinvestment Act." May 8, 2023. See disclaimer and update policy.

X

X  facebook

facebook

email

email