The Second Bank of the United States

1816-1841

In the years leading up to the War of 1812, the U.S. economy had been on the upswing. The war with Britain, however, disrupted foreign trade. As one of the United States' largest trading partners, Britain used its navy to blockade U.S. trade with other nations. The war prevented U.S. farmers and manufacturers from exporting merchandise, blocked U.S. merchants and fisherman from sailing the high seas, and curtailed federal government revenues, which were derived mainly from tariffs on trade. By 1815, the United States found itself heavily in debt, much like it had been at the end of the Revolutionary War thirty years earlier.

In January 1815, the United States had been without a national bank for almost four years. Many people thought that a successor would again provide relief for the country's ailing economy and help in paying its war debt. Six men figured prominently in establishing this new entity, commonly referred to as the second Bank of the United States: the financiers John Jacob Astor, David Parish, Stephen Girard, and Jacob Barker; Alexander Dallas, who would become secretary of the Treasury in 1814; and Rep. John C. Calhoun of South Carolina. These men thought that reestablishing a national bank would solve some of the country's economic woes. In particular, Astor, Parish, Girard, and Barker—as lenders and financiers—felt that a national bank would restore a stable currency, thereby avoiding bouts of inflation and insuring their business interests.

Establishing a Second National Bank

Despite broad support for reestablishing a national bank, the road to re-creation was not smooth. In January 1814, Congress received a petition signed by 150 businessmen from New York City, urging the legislative body to create a second national bank. In February, and again in November, Calhoun put forth plans to create a bank that would be headquartered in the District of Columbia, but his bills did not pass.

In April 1814, President James Madison, who had opposed the creation of the first Bank of the United States in 1791, reluctantly admitted to the need for another national bank. He believed a bank was necessary to finance the war with Britain. But later that year, progress in peace negotiations led Madison to withdraw his support for the proposed national bank.

After peace with Britain came in 1815, Congress rejected new efforts to create the bank. In the months that followed, however, the federal government's financial position deteriorated amid a broader economic downturn. Many state-chartered banks had stopped redeeming their notes, which convinced Madison and his advisers that the time had come to move the country toward a more uniform, stable paper currency. In his annual report, Dallas again called for the establishment of a national bank. After much debate and a couple of additional attempts, Madison finally signed in April 1816 an act establishing the second Bank of the United States.

Bank Structure and Operations

The Bank opened for business in Philadelphia in January 1817. It had much in common with its forerunner, including its functions and structure. It would act as fiscal agent for the federal government—holding its deposits, making its payments, and helping it issue debt to the public—and it would issue and redeem banknotes and keep state banks' issuance of notes in check. Also like its predecessor, the Bank had a twenty-year charter and operated as a commercial bank that accepted deposits and made loans to the public, both businesses and individuals. Its board consisted of twenty-five directors, with five appointed by the president and confirmed by the Senate.

The capitalization for the second Bank was $35 million, considerably higher than the $10 million underwriting of the first Bank. Subscriptions went on sale in July 1816, and the sale period was set at three weeks. To make it easier for investors to buy subscriptions, sales were held in twenty cities. After three weeks, $3 million of scrips remained unsold, so Philadelphia banker Stephen Girard bought them.

The Bank's reach was far greater than that of its predecessor. Its branches eventually totaled twenty-five in number, compared to only eight for the first Bank. The extensive branch network aided the country's westward expansion and its economic growth in several ways. The branches provided credit to businesses and farmers, and these loans helped finance the production of goods and agricultural output as well as the shipment of these goods to domestic and foreign destinations. Moreover, the network helped move the money deposited in the branches to other parts of the nation, facilitating both the government's ability to make payments and the branches' ability to supply credit.

Unlike modern central banks, the Bank did not set monetary policy as we know it today. It also did not regulate, hold the reserves of, or act as a lender of last resort for other financial institutions. Nonetheless, its prominence as one of the largest U.S. corporations and its branches' broad geographic position in the expanding economy allowed it to conduct a rudimentary monetary policy. The Bank's notes, backed by substantial gold reserves, gave the country a more stable national currency. By managing its lending policies and the flow of funds through its accounts, the Bank could—and did—alter the supply of money and credit in the economy and hence the level of interest rates charged to borrowers.

These actions, which had effects similar to today's monetary policy actions, can be seen most clearly in the national bank's interactions with state banks. In the course of business, it would accumulate the notes of the state banks and hold them in its vault. When it wanted to slow the growth of money and credit, it would present the notes for collection in gold or silver, thereby reducing state banks' reserves and putting the brakes on state banks' ability to circulate new banknotes (paper currency). To speed up the growth of money and credit, the Bank would hold on to the state banks' notes, thereby increasing state banks' reserves and allowing those banks to issue more banknotes through their loan-making process.

Bank Leadership

The first president of the Bank was William Jones, a political appointee and a former secretary of the Navy who had gone bankrupt. Under Jones's leadership, the Bank first extended too much credit and then reversed that trend too quickly. The result was a financial panic that drove the economy into a steep recession.

When Jones resigned in 1819, shareholders elected Langdon Cheves, an attorney from South Carolina who had served as speaker of the House of Representatives, as president of the Bank. Cheves cut in half the number of second Bank banknotes in circulation, made fewer loans, foreclosed on mortgages, and exerted more control over the Bank's branches. He presented state banknotes for specie, a request that sent many state-chartered financial institutions into bankruptcy because they did not have enough gold and silver on hand to cover the redemptions. Another depression, characterized by deflation and high unemployment, ensued. Although the economic slump was part of a worldwide downturn, the Bank's policies magnified the contraction in the United States. Public opinion started turning against the Bank as many believed it contributed to the recession.

In 1823, Cheves withdrew his name from consideration for reelection to the top Bank post, and Nicholas Biddle, a member of a wealthy and prominent Philadelphia family, became head of the Bank. Biddle had previously served on the Bank's board of directors and in the Pennsylvania legislature. With Biddle's guidance, animosity toward the Bank diminished. The Bank contributed significantly to economic stability and growth. Biddle increased the number of notes issued by the Bank and restrained the expansion of the quantity of state banks' notes by pressing them to redeem their own notes in specie.

The Battle Over the Second Bank

In 1828, Andrew Jackson, hero of the Battle of New Orleans and a determined foe of banks in general and the second Bank of the United States in particular, was elected president of the United States. Jackson's dislike of the Bank may have been fueled by rumors that Henry Clay, a congressman from Kentucky, was manipulating the Bank to help Jackson's opponent, John Quincy Adams, but it did not rise to a major campaign issue.

In contrast, the election of 1832, which sent Jackson back to the White House, put the Bank in the spotlight. A request to renew the Bank's charter was sent to Congress in January 1832, four years before the charter was set to expire. The legislation passed both the House and Senate, but it failed to garner enough votes to overcome Jackson's veto.

Why was Jackson so opposed to the Bank? On a personal level, Jackson brought with him to Washington a strong distrust of banks in general, stemming, at least in part, from a land deal that had gone sour more than two decades before. In that deal, Jackson had accepted paper notes—essentially paper money—as payment for some land he had sold. When the buyers who had issued the notes went bankrupt, the paper he held became worthless. Although Jackson managed to save himself from financial ruin, he never trusted paper notes again. In Jackson's opinion, only specie—silver or gold coins—qualified as an acceptable medium for transactions. Since banks issued paper notes, Jackson found banking practices suspicious. Jackson also distrusted credit—another function of banks—believing people should not borrow money to pay for what they wanted.

Jackson's distrust of the Bank was also political, based on a belief that a federal institution such as the Bank trampled on states' rights. In addition, he felt that the Bank put too much power in the hands of too few private citizens -- power that could be used to the detriment of the government. The Bank also lacked an effective system of regulation. In other words, it was too far outside the jurisdiction of Congress, the president, and voters.

Biddle, who served as president from 1823 until the Bank's demise in 1836, refused to accept any criticism of the Bank's operations, especially claims about the mismanagement of some of the Bank's branches. He also was not above allowing the Bank to make loans to his friends while denying loans to those less friendly. These actions subjected the Bank to public criticism. Despite all this, Biddle was an excellent administrator who understood banking.

Jackson saw his 1832 win as validation of antibank sentiment. Shortly after the election, Jackson ordered that federal deposits be removed from the second National Bank and put into state banks. Although Jackson's order met with heavy criticism from members of his administration, most of the government's money had been moved out of the Bank by late 1833. The loss of the federal government's deposits caused the Bank to shrink in both size and influence.

Meanwhile, in Philadelphia, Biddle responded to Jackson's action by announcing that the Bank would (or could) not respond to the loss of government deposits by attracting new private deposits or raising new capital. Instead, the Bank would limit credit and call in loans. This contraction of credit, he believed, might create a backlash against Jackson and force the president to relent and redeposit government funds in the Bank, perhaps even renewing the charter. But Biddle's move backfired: in the end, it helped to support Jackson's claim that the Bank had been created to serve the interests of the wealthy, not to meet the nation's financial needs.

Closing of the Second Bank of the United States

One event that foreshadowed the Bank's demise was its supporters' inability to muster a two-thirds majority to override Jackson's veto in 1832. More damaging was the removal of federal deposits in 1833, resulting not only in a reduction in the Bank's size but also in its ability to influence the nation's currency and credit. In April 1834, the House of Representatives voted against rechartering the Bank and confirmed that federal deposits should remain in state banks. These developments, coupled with Jackson's determination to do away with the Bank and the widespread defeat of the pro-Bank Whig Party in the 1834 congressional elections, sealed the Bank's fate.

It would be more than seventy-five years before the United States made another attempt to establish a central bank. During that period, the U.S. economy experienced several banking crises. But after the Panic of 1907, which triggered a nationwide suspension of payments and a deep recession, Congress established a commission to look into ways to improve how the banking system responsed to the shocks. The commission's findings led to the creation of the Federal Reserve System in 1913.

This article is adapted from the Federal Reserve Bank of Philadelphia's publication "The Second Bank of the United States: A Chapter in the History of Central Banking." To order print copies of the publication visit https://www.philadelphiafed.org/education/publication-orders

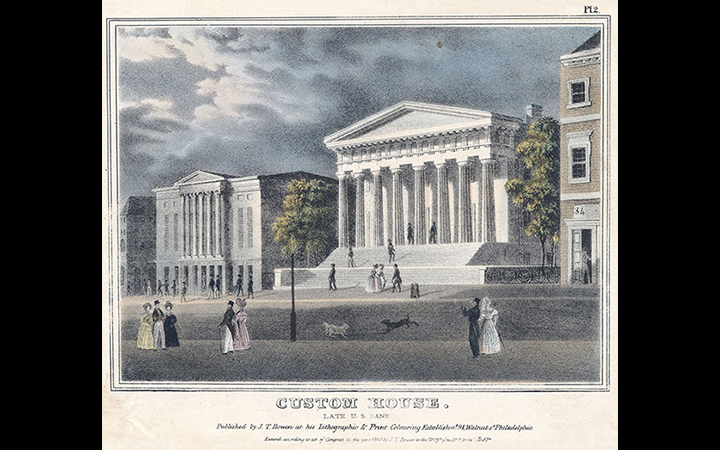

Image of Custom House by J.C. Wild, printed by John T. Bowen, c.1848, courtesy Library Company of Philadelphia, accession number P.2227

Bibliography

Bordo, Michael D., and Joseph G. Haubrich. "Credit Crises, Money, and Contractions: An Historical View." Journal of Monetary Economics vol. 57, no. 1 (January 2010): pp. 1-18.

Catterall, Ralph C.H. The Second Bank of the United States. Chicago: University of Chicago Press, 1903.

Hammond, Bray. Banks and Politics in America from the Revolution to the Civil War. Princeton, NJ: Princeton University Press, 1957.

Kaplan, Edward S. The Bank of the United States and the American Economy. Westport, CT: Greenwood Press, 1999.

Remini, Robert. Andrew Jackson and the Bank War: A Study in the Growth of Presidential Power. New York: W.W. Norton and Company, 1967.

Walters, Raymond, Jr. "The Origins of the Second Bank of the United States." Journal of Political Economy vol. 53, no. 2 (June 1945): pp. 115-31.

Written as of December 5, 2015. See disclaimer and update policy.

X

X  facebook

facebook

email

email