Roosevelt's Gold Program

1933

The Roosevelt administration's policies regarding gold and dollars were controversial and consequential.

The United States had been on a de facto gold standard since the 1830s and de jure gold standard since 1900. In 1913 the gold standard was built into the framework of the Federal Reserve. The law required the Federal Reserve to hold gold equal to 40 percent of the value of the currency it issued (technically termed the Federal Reserve Note but colloquially called the dollar) and to convert those dollars into gold at a fixed price of $20.67 per ounce of pure gold.

The Federal Reserve typically held more than enough gold to back the currency it had issued. Bankers called the excess "free gold." The Federal Reserve needed a stock of free gold sufficient to satisfy redemption requests that might occur in the near future. The Federal Reserve could increase the stock of free gold by increasing interest rates, which encouraged Americans to deposit in banks and encouraged foreigners to invest in the United States, shifting gold from the pockets of the public (both here and abroad) to the vaults of Federal Reserve district and member banks. Conversely, when the Federal Reserve lowered interest rates, gold would flow from its coffers into the hands of the public both at home and overseas.

During the financial crisis of 1933 that culminated in the banking holiday in March 1933, large quantities of gold flowed out from the Federal Reserve. Some of this outflow went to individuals and firms in the United States. This domestic drain occurred because individuals and firms preferred holding metallic gold to bank deposits or paper currency. Some of the gold flowed to foreign nations. This external drain occurred because foreign investors feared a devaluation of the dollar. Together, the internal and external drains consumed the Federal Reserve's free gold. In March 1933, when the Federal Reserve Bank of New York could no longer honor its commitment to convert currency to gold, President Franklin Roosevelt declared a national banking holiday.

The Roosevelt administration's policies regarding gold responded to this crisis. The policies unfolded through three phases.

During the first phase, in the spring and summer of 1933, the Roosevelt administration suspended the gold standard.

In March 1933, the Emergency Banking Act gave the president the power to control international and domestic gold movements. It also gave the secretary of the treasury the power to compel surrender of gold coins and certificates. The administration waited before employing these powers, in hope that the situation would correct itself, but gold outflows continued.

On April 20, President Roosevelt issued a proclamation that formally suspended the gold standard. The proclamation prohibited exports of gold and prohibited the Treasury and financial institutions from converting currency and deposits into gold coins and ingots. The actions halted gold outflows.

In May 1933, the administration once again weakened links to gold. The Thomas amendment to the Agricultural Relief Act gave to the president the power to reduce the gold content of the dollar by as much as 50 percent. The president also received the power to back the dollar with silver, rather than gold, or with both silver and gold, at silver prices determined by the administration.

On June 5, a congressional resolution abrogated gold clauses in all contracts, both government and private. Gold clauses guaranteed that contracts would be repaid in gold or in gold's monetary equivalent, at the value set in 1900. A series of cases in the United States Supreme Court upheld the constitutionality of these actions.1

Together, these measures weakened the dollar's link to gold. The dollar nominally retained its value, but the Department of the Treasury would not exchange dollars for gold and forbade the Federal Reserve from doing so. The administration could, at any time, change the dollar's value or begin backing the dollar with silver. In the future, the government might (or might not) allow the conversion of paper dollars into gold (or silver or both) at some price that the government would announce at some point in the future. To ordinary men and women, in other words, the dollar's value in terms of gold (and other goods) was uncertain.

The second phase of the Roosevelt administration's gold policy began in October 1933 with the inauguration of the gold purchase plan.

This phase involved the deliberate devaluation of the dollar. The government did this by authorizing the Reconstruction Finance Corporation to buy gold at increasing prices. These purchases raised gold's value in terms of dollars, conversely lowering the dollar's value in terms of gold and in terms of foreign currencies, whose value in gold remained pegged at old prices.

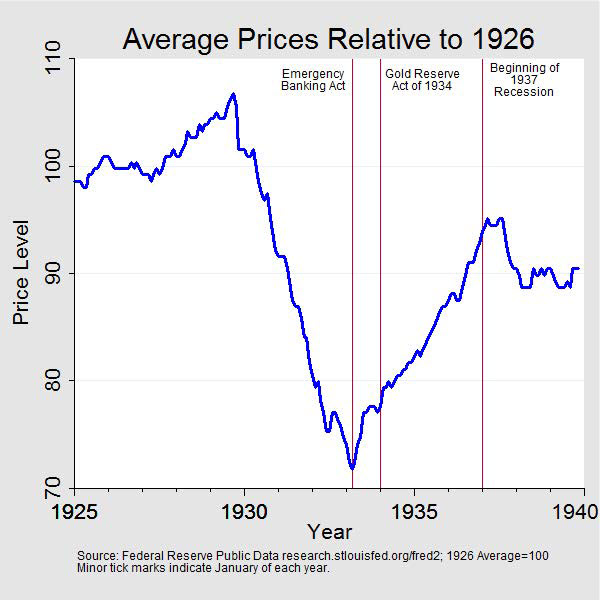

The goal of these programs was to raise American prices of commodities like wheat and cotton, returning them to the level of 1926, before the beginning of the contraction. This reflation would counteract the deflation that had dragged the economy into the abyss. The reflation would relieve debtors, resuscitate banks, and revive businesses. The reflation would lower prices of American goods abroad, encouraging exports, and raise prices of foreign goods in the US, discouraging imports.

The third phase began in January 1934, with the Gold Reserve Act and a return to stability. The new stability solidified the emergency measures enacted in 1933, resurrected the gold standard, and re-established financial links between America and the rest of the world.

At the time, the Roosevelt administration's gold policies were controversial. Critics asserted that they were "completely immoral" and "a flagrant violation of the solemn promises made in the Gold Standard Act of 1900" and promises made to purchasers of Liberty and Victory Loans during World War I (Angell 1934, 492). Critics claimed these policies set the stage for an inflation of supply of credit and currency, which would trigger a speculative boom bigger than ever before and eventually end in a disastrous depression (Bullock 1934, 44). Critics claimed that these policies delayed economic recovery by frightening and confusing consumers and businessmen.

Economic historians have come to a different conclusion. Scholars believe Roosevelt's reflation accelerated America's recovery from the Great Depression. These scholars include Milton Friedman and Anna Schwartz (1963), who vigorously criticized Federal Reserve policies during the 1960s and 1970s, and Allan Meltzer (2003), a famous historian and prominent critic of Federal Reserve policies following the financial crisis of 2008. These scholars also include academics who work or have worked as policymakers in recent years such as Ben Bernanke (2013) and Christina Romer (1992). On this issue, seminal statistical analysis appears in an essay by Ehsan Choudhri and Levis Kochin (1980). Perhaps the most persuasive research belongs to Barry Eichengreen and Jeffrey Sachs (1985). Their essay demonstrated that economic recovery in the United States and in most of the world's leading industrial nations began at the time they suspended the gold standard and reflated their economies.

How did Roosevelt's gold policies affect the Federal Reserve? In this period, the president, Congress, and the Treasury directly controlled monetary policy. The Federal Reserve sat "in the back seat" and implemented policies dictated by the federal government, to quote the conclusion of Robert Hetzel, a senior economist at the Federal Reserve Bank of Richmond.

Lester Chandler, a noted academic economist and former deputy chairman of the board of directors of the Federal Reserve Bank of Philadelphia, describes the Federal Reserve System's internal debates on this issue. A few of the leaders of the Federal Reserve supported the administration's gold policies. Many of the leaders opposed these plans. Officers and directors of the Federal Reserve Bank of New York, which was designated agent for implementing the gold purchase program, "debated whether they could ethically implement a policy which they considered to be wholly unsound. However, they agreed to do so on the understanding that they were acting solely as a fiscal agent for the Treasury, and that the latter took full responsibility for decisions and actions" (Chandler 1971, 289).

The opinions of the leaders of the Federal Reserve System have changed dramatically on this issue, as Ben Bernanke makes clear in his recent speeches and writings on this topic (2013).

Endnotes

- 1 The Supreme Court cases included United States v. Bankers Trust Co, 294 U.S. 240 (1935); Nortz v. United States, 294 U.S. 317 (1935); and Perry v. United States, 294 U.S. 330 (1935).

Bibliography

Angell, James W. "Gold, Banks, and the New Deal." Political Science Quarterly 49, no. 4 (December 1934): 481-505.

Bernanke, Ben. The Federal Reserve and the Financial Crisis. Princeton: Princeton University Press, 2013.

Bordo, Michael D. "The Classical Gold Standard—Some Lessons for Today." Federal Reserve Bank of St. Louis Review 63, no. 5 (May 1981): 2-17.

Bullock, C. J. "Devaluation." The Review of Economics and Statistics 16, no. 2 (February 15, 1934): 41-44.

Chandler, Lester V. American Monetary Policy, 1928-1941. New York: Harper and Row Publishers, 1971.

Choudhri, Ehsan U and Levis A. Kochin. "The Exchange Rate and the International Transmission of Business Cycle Disturbances: Some Evidence from the Great Depression," Journal of Money, Credit and Banking 12, no. 4, part 1 (November 1980): 565-74.

Eichengreen, Barry and Jeffrey Sachs. "Exchange Rates and Economic Recovery in the 1930s." The Journal of Economic History, 45, no. 4 (December 1985): 925-46.

Fisher, Irving. "Reflation and Stabilization." Annals of the American Academy of Political and Social Science 171 (January 1934).

Friedman, Milton and Anna Schwartz. A Monetary History of the United States, 1867-1960. Princeton: Princeton University Press, 1963.

Hetzel, Robert. The Monetary Policy of the Federal Reserve: A History. Cambridge: Cambridge University Press, 2008.

Meltzer, Allan. A History of the Federal Reserve: Volume 1, 1913 to 1951. Chicago: University of Chicago Press, 2003.

Romer, Christina D. "What Ended the Great Depression?" The Journal of Economic History, 52, no. 4 (December 1992): 757-84.

Written as of November 22, 2013. See disclaimer and update policy.

X

X  facebook

facebook

email

email