Financial Services Modernization Act of 1999 (Gramm-Leach-Bliley)

November 12, 1999

By the late 1990s, consolidation in the banking industry had been an ongoing trend for twenty years. The number of commercial banks in the United States had fallen from more than 14,000 in 1984 to fewer than 9,000 in 1999, while the average size of those banks had grown. This was part of a broader trend of consolidation in financial services industries.

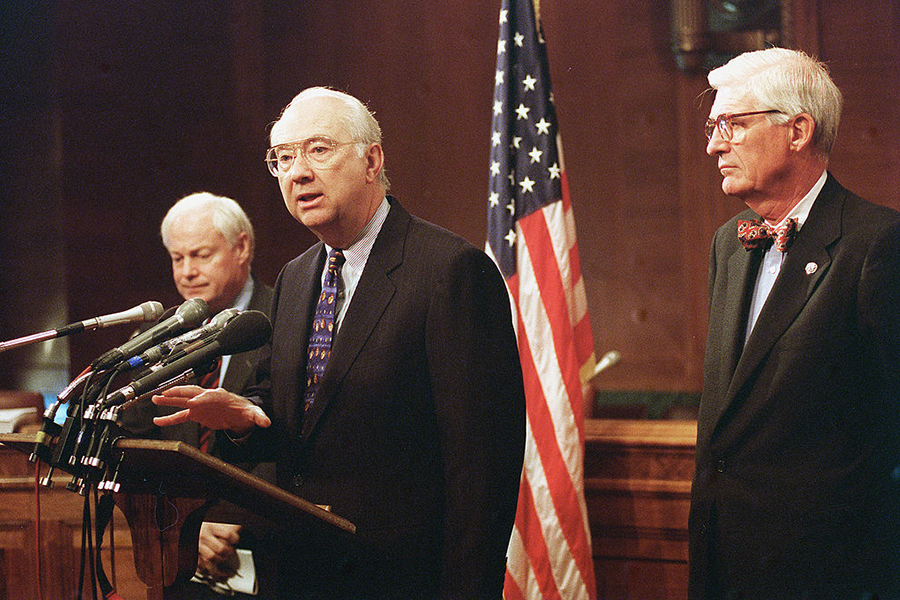

Moreover, financial services that had been separate for the latter half of the twentieth century—commercial banking, investment banking, and insurance—had become more integrated. Beginning in the late 1980s, some commercial banking organizations had started moving into underwriting securities (stocks and corporate bonds) and a few had also begun selling insurance. By 1999, financial integration was well underway, and Congress decided to act. In November, it passed and President Clinton signed the Financial Services Modernization Act (commonly called Gramm-Leach-Bliley, in acknowledgment of its primary sponsors in Congress), rewriting the financial regulation rulebook and giving the Fed new supervisory powers.

Background

The Banking Act of 1933 (Glass-Steagall) had set up a wall of separation between certain sectors of the financial services industry. These restrictions were a response to the perception that commercial and investment banking had become too intertwined leading up to the 1929 stock market crash—that banks had taken undue risk with depositors' savings in the financial markets or were promoting the securities they underwrote to their customers, leading to conflicts of interest.

However, Glass-Steagall contained language that made some financial integration possible. Most notable was Section 20 of the law, which separated commercial and investment banking. The law prohibited bank affiliation with firms that were "engaged principally" in underwriting and dealing securities. This made it possible for bank holding companies to create subsidiaries or acquire firms involved in some underwriting or dealing, as long as most of their activities were otherwise permissible. The first of these Section 20 subsidiaries was approved by the Fed in 1987, and by 2000 there were fifty-one nationwide.

The primary routes for banks to sell insurance were under state laws for state-chartered banks, but national banks were allowed to provide credit-related insurance and operate insurance agencies in small towns where they had bank offices. These laws limited bank insurance activities, but in 1998 Citicorp, a large bank holding company, announced plans to merge with Travelers Insurance, forming Citigroup. This merger was not yet permissible under existing regulations; it was made in anticipation of a change in the law then under discussion in Congress.

Bibliography

Federal Reserve Bank of Minneapolis, The Region: Issue on Financial Modernization, March 2000.

Furlong, Fred. "The Gramm-Leach-Bliley Act and Financial Integration." Federal Reserve Bank of San Francisco Economic Letter 2000-10, March 31, 2000.

Matthews, Dylan. "Elizabeth Warren and John McCain want Glass-Steagall back. Should you?" Washington Post, July 12, 2013, https://www.washingtonpost.com/news/wonk/wp/2013/07/12/elizabeth-warren-and-john-mccain-want-glass-steagall-back-should-you/?variant=bd6f491cfaef7f1f.

Yeager, Timothy J., Fred C. Yeager, and Ellen Harshman. "The Financial Services Modernization Act: Evolution or Revolution." Journal of Economics and Business 59, no. 4 (July-August 2007): 313- 39.

Written as of November 22, 2013. See disclaimer and update policy.

X

X  facebook

facebook

email

email