The First Bank of the United States

1791-1811

The War for Independence was over, but all was not well. The United States of America, a name the new country had adopted under the Articles of Confederation, was beset with problems. The 1780s saw widespread economic disruption. The new nation's leaders had their work cut out for them: reestablishing commerce and industry, repaying war debt, restoring the value of the currency, and lowering inflation.

One prominent architect of the fledgling country—Alexander Hamilton, the first secretary of the Treasury under the new Constitution—had ambitious ideas about how to solve some of these problems. One of those was creating a national bank. In December 1790, Hamilton submitted a report to Congress in which he outlined his proposal. Hamilton used the charter of the Bank of England as the basis for his plan. He argued that an American version of this institution could issue paper money (also called banknotes or currency), provide a safe place to keep public funds, offer banking facilities for commercial transactions, and act as the government's fiscal agent, including collecting the government's tax revenues and paying the government's debts.

Not everyone agreed with Hamilton's plan. Thomas Jefferson was afraid that a national bank would create a financial monopoly that might undermine state banks and adopt policies that favored financiers and merchants, who tended to be creditors, over plantation owners and family farmers, who tended to be debtors. Such an institution clashed with Jefferson's vision of the United States as a chiefly agrarian society, not one based on banking, commerce, and industry. Jefferson also argued that the Constitution did not grant the government the authority to establish corporations, including a national bank. Despite the opposing voices, Hamilton's bill cleared both the House and the Senate after much debate. President Washington signed the bill into law in February 1791.

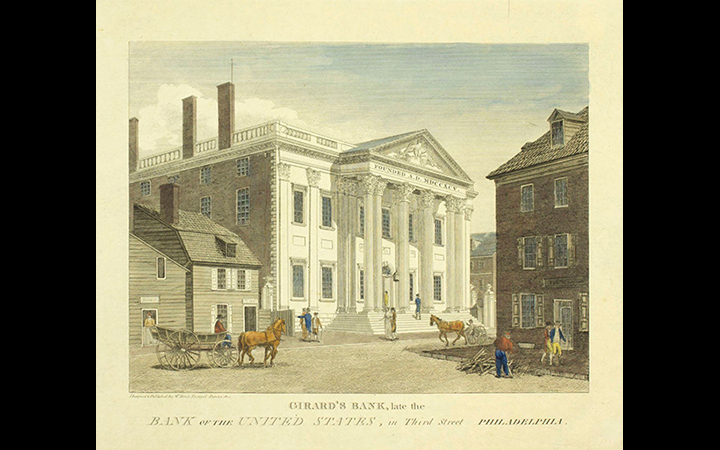

The Bank of the United States, now commonly referred to as the first Bank of the United States, opened for business in Philadelphia on December 12, 1791, with a twenty-year charter. Branches opened in Boston, New York, Charleston, and Baltimore in 1792, followed by branches in Norfolk (1800), Savannah (1802), Washington, D.C. (1802), and New Orleans (1805). The bank was overseen by a board of twenty-five directors. Thomas Willing, who had been president of the Bank of North America, accepted the job as the new national bank's president.

The Bank of the United States started with capitalization of $10 million, $2 million of which was owned by the government and the remaining $8 million by private investors. The size of its capitalization made the Bank not only the largest financial institution, but the largest corporation of any type in the new nation. The bank's sale of shares was the largest initial public offering (IPO) in the country to date. Many of the initial investors were foreign, a fact that did not sit well with many Americans, even though the foreign shareholders could not vote. The IPO did not offer shares for immediate delivery but rather subscriptions, or "scrips," that acted as a down payment on the purchase of bank stock. When the bank subscriptions went on sale in July 1791, they sold so quickly that many would-be investors were left out, prompting fierce bidding in the secondary market for scrips.

The Bank acted as the federal government's fiscal agent, collecting tax revenues, securing the government's funds, making loans to the government, transferring government deposits through the bank's branch network, and paying the government's bills. The bank also managed the U.S. Treasury's interest payments to European investors in U.S. government securities. Although the U.S. government, the largest shareholder, did not directly manage the bank, it did garner a portion of the bank's profits. The Treasury secretary had the authority to inspect the bank's books, require statements of the bank's condition as frequently as once each week, and remove the government's deposits at any time for any reason. To avoid inflation and the appearance of impropriety, the Bank was forbidden from buying U.S. government bonds.

In addition to its activities on behalf of the government, the Bank of the United States also operated as a commercial bank, which meant it accepted deposits from the public and made loans to private citizens and businesses. Its banknotes (paper currency) most commonly entered circulation through the loan process. It extended more loans and issued more currency than any other bank in the nation because it was the largest financial institution in the United States and the only institution holding federal government deposits and possessing branches throughout the nation. Banknotes issued by the Bank of the United States were widely accepted throughout the country. And unlike notes issued by state banks, Bank of the United States notes were the only ones accepted as payment of federal taxes.

Bibliography

Cowen, David J. The Origins and Economic Impact of the First Bank of the United States, 1791-1797. New York: Garland Publishing, 2000.

Cowen, David J., Richard Sylla, and Robert E. Wright, "The U.S. Panic of 1792: Financial Crisis Management and the Lender of Last Resort," mimeo (July 2006).

Hammond, Bray. Banks and Politics in America from the Revolution to the Civil War. Princeton: Princeton University Press, 1957.

Wright, Robert E. The First Wall Street: Chestnut Street, Philadelphia, and the Birth of American Finance. Chicago: University of Chicago Press, 2005.

Wright, Robert E., and David J. Cowen. Financial Founding Fathers: The Men Who Made America Rich. Chicago: University of Chicago Press, 2006.

Written as of December 4, 2015. See disclaimer and update policy.

X

X  facebook

facebook

email

email