Bank Capital Standards

A primary purpose of bank capital is to protect depositors from losses and banks from failure. Ensuring adequate capital has been a consistent historical priority of US banking regulators as part of their role in promoting a safe banking system. Capital—broadly defined as the difference between a bank's assets and liabilities—was for many years evaluated largely on a case-by-case basis. Regulators "long sought to find a satisfactory yardstick for measuring the adequacy of a bank's capital" but feared that none fully captured the complex risks faced by banks (Federal Reserve Bank of New York 1952). However, concerns about the capital positions of the US banks, especially the largest ones, as well as the desire to ensure a level playing field internationally led to the development of uniform and specific capital standards in the 1980s. These standards have since been refined several times, including major revisions after the 2007-2009 financial crisis. The work of refining capital standards remains ongoing, as US regulators proposed new rules in 2023 to finalize post-crisis reforms.

Defining bank capital

A bank's common stock and retained earnings have always been the core capital items. Stockholders take losses on their investments before a bank's creditors (such as depositors) do, and dividends to stockholders can be restricted to help a bank improve its financial position. Regulators have debated the merits of treating other balance sheet items as forms of capital for regulatory purposes. For example, regulators have been more inclined to consider debt a form of capital if the debt is long-term, convertible into equity, or not redeemable—qualities that cause it to absorb losses before depositors.

Banking regulators—the Federal Reserve, Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and state banking regulators—were once somewhat uncoordinated in how they defined bank capital. For example, the OCC once was alone in embracing some debt or preferred stock as a form of capital in the early 1960s (OCC 1962, Hahn 1966, p. 210; Orgler and Wolkowitz 1976, pp. 42-45). Starting in 1981, US federal regulators began coordinating on uniform definitions of "primary" and "secondary" capital (Federal Reserve Bulletin January 1982).

International coordination on capital standards began in the late 1980s, in reaction to growing international competition among banks (Taylor 1988, Tarullo 2008). The result has been a series of agreements known as the Basel accords. The rules implementing Basel I in the United States were finalized in 1989; they were further developed by the rules implementing Basel II in 2007 and Basel III in 2013. In 2023, US regulators proposed new rules to implement the Basel III "Endgame" accords. In defining capital, these accords have set out what items count as "tier 1," "tier 2," and "tier 3" capital.

Long-term trends in bank capital positions

The amount of capital held by banks over time has been shaped by a number of factors, including the ease of raising capital, the choices made by bankers, and supervision and regulation.

A simple way of measuring the capital position of a bank is by comparing its capital to total assets. By this measure, aggregate capital positions at US banks were in general decline in the late 19th and early 20th centuries (Smith 1946). This long decline reflected the development of the US banking system. Banks found a growing market for their liabilities, such as deposits, and found issuing those liabilities to be less expensive than raising capital. Banks increased their capital positions somewhat during the strong economic conditions of the 1920s, when raising capital was relatively inexpensive; but this changed in the depression of the 1930s, when capital was again costly (Calomiris and Wilson 2004). Capital positions then declined sharply during World War II, well below historic norms, as banks expanded their balance sheets rapidly by acquiring securities issued by the federal government to fund the war.

By the 1950s "the problem of bank capital" was being widely discussed in banking and regulatory circles (Pritchard 1953). Bankers may have become more comfortable with thinner capital positions and riskier business models as a result of some changes in banking laws, such as the establishment of federal deposit insurance. In the mid-1970s, Federal Reserve Board members were "highly concerned with the capital position of U.S. banks," as aggregate capital positions had reached historic lows and a few large banks had failed (Holland 1975). Federal Reserve Board chairmen Arthur Burns lamented that bankers had "progressively shed much of the caution that had carried over from the Great Depression" (Burns 1977).

Since the mid-1970s bank capital positions have been on a generally increasing trend. Some major changes in policy have been an important factor in this trend: the introduction of minimum capital standards in 1981, the Basel I accords several years later, and higher requirements after the 2007-2009 financial crisis.

The use of simple capital measures by regulators

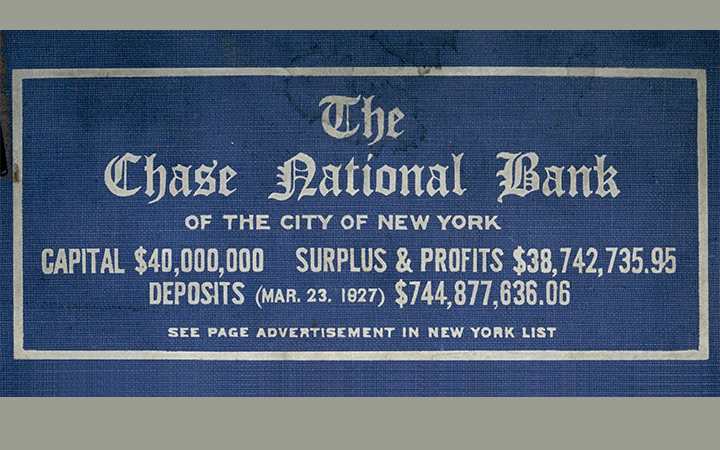

An "old banking shibboleth" was that capital should be at least one-tenth the level of deposits (Robertson 1954). While some states required minimum capital ratios of this kind (Robinson 1941), banks with federal charters were required to have only a minimum dollar amount of capital. As a result, at least through the 1920s, the largest banks tended to have capital well above regulatory minimums and "the market, rather than government regulation, dictated the amount of capital" (Koch, Richardson, and Van Horn 2016).

Until the 1980s, federal regulators remained reluctant to require or even recommend a minimum ratio of capital to bank assets or deposits, with some exceptions from time to time (see OCC 1914, p. 20, and FDIC 1939, p. 11). For example, in 1952 the Board of Governors judged that "it is impossible to develop any formula which eliminates the need for the exercise of sound judgment in determining the adequacy of capital of any given bank" (Board of Governors 1952). Bankers shared these concerns and came to strongly resist the use of simple capital ratios even as a starting point or screening method (American Bankers Association 1954, p. 2), an approach largely adopted by the OCC (OCC 1963, p. 322).

The bank stresses of the 1970s and early 1980s ultimately led regulators to revise their views on minimum capital requirements. The Fed and OCC announced a minimum capital-to-assets requirement in 1981 for all but the largest banks, which they continued to evaluate on a case-by-case basis, and the FDIC announced its own fairly similar requirement. An industry-wide minimum was announced in 1985, revised to a different measure (tier 1 capital to assets) in 1990, and raised in 2013 as part of the response to the 2007-2009 financial crisis and the Basel III agreement.

The post-financial-crisis reforms also included the development of a new measure known as the supplementary leverage ratio (SLR). The SLR compares tier 1 capital to a denominator equal to total assets plus additional amounts reflecting off-balance-sheet exposures from items such as loan commitments or derivatives. The SLR minimum was set at a higher level for the largest banks, reflecting concerns about their systemic importance. The recent Basel III Endgame proposal involves some modification to how off-balance-sheet items are included in the SLR's denominator.

The development of risk-based capital measures

Comparing capital to assets is simple and transparent but has shortcomings as it does not account for the riskiness of a bank's assets or off-balance-sheet activities such loan commitments and derivatives. For example, government securities pose relatively little credit risk. During WWII, regulators stated that "there will be no deterrents in examination or supervisory policy to investments by banks in Government securities." More recently, during the COVID-19 pandemic, regulators temporarily allowed Treasury instruments to be excluded from the denominator of the SLR to ease strains in the Treasury market and promote lending to households and businesses.

The low post-WWII capital positions led regulators to develop a wide variety of methods of assessing risk in the 1950s. See, for example, the variety of methods referred to in hearings on the Utah-based Continental Bank (Federal Reserve Bulletin, August 1960) or Ryon (1966). One method was known as the Board's ABC form, i.e., the form for Analyzing Bank Capital (Board of Governors 1956).1 The Fed treated its ABC form as a guide to "norms" but warned that it could "provide no more than an initial presumption as to the actual capital required by a particular bank." The FDIC and OCC developed their own approaches (Hahn 1966, chapter 2).

After the imposition of minimum capital ratios in 1981, federal regulators soon proposed risk-adjusted standards as well, amidst concerns that the simple measures encouraged banks to take on risky assets. Coordination on risk adjustment procedures came in the 1980s in the form three proposals in quick succession: 1986 proposals coordinated by the three US banking regulators; a 1987 proposal negotiated with regulators in the United Kingdom; and a 1988 proposal as part of the Basel I accords that grew out of and superseded the US-UK proposal (see FDIC 1997, chapter 2, and Tarullo 2008, chapter 3). The accord resulted in the creation of a new "risk-weighted asset" measure, calculated by grouping assets into five different categories based on credit risk.

Proposals to refine the Basel I risk adjustment methodology surfaced almost as soon as it was implemented. By the 1990s, risk management at large banks went beyond grouping assets into coarse categories by using models to account for the many factors that shape the credit risk of any individual asset. Federal Reserve Board Governor Roger Ferguson viewed Basel I as "deficient for our larger banks" (Ferguson 2003). The Basel II standards allowed for the use of internal bank risk assessment models or, if available, ratings from credit rating agencies. The Basel II standards included several other changes, such as evaluating not just credit risk (risk that a borrower will not repay) but also market risk (risk that the market value of an asset will change) and interest rate risk.

More recently, the 2007-2009 financial crisis has led regulators to modify risk-adjusted capital requirements in several ways, including changes to the risk weights assigned to specific assets, eliminating the use of credit ratings, and raising minimum requirements for the quantity and quality of capital especially for the largest systemically important banks (Tarullo 2017). In addition to the higher minimum, banks must hold an additional "capital conservation buffer" or become subject to restrictions on dividends and other payments. Regulators also now have the option of imposing a countercyclical capital buffer based on macroeconomic conditions. Finally, the Basel III Endgame proposals released in 2023 seek to "restore credibility" to risk adjustment in part by constraining the use of banks' internal models.

Enforcement

The legal authority of federal regulators to establish and enforce minimum capital positions was clearly and specifically authorized for the first time in the International Lending Supervision Act in 1983. Several years later, Congress further empowered and required regulators to take specific actions if banks fall below minimum requirements (see the Federal Deposit Insurance Corporation Improvement Act of 1991). One important case in the lead-up to the 1983 legislation took place in 1981, when a federal court ruled that the OCC could not require that banks maintain a minimum capital-to-asset ratio (Tufts and Moloney 2022). In an earlier case, in 1956, the Federal Reserve had ordered the Utah-based Continental Bank and Trust to raise additional capital.2 Continental's president contended that the Fed should not be able to "prescribe any kind of conditions it pleased" (Cosgriff 1957). The case concluded after several years of litigation when new management agreed to raise capital, leaving unresolved for a time the underlying legal challenge to the Fed's authority (Hahn 1966).

Conclusion

Much has changed in the economic environment affecting bank capital and its regulation since the Fed's establishment. International competition among banks has necessitated international coordination. The capital positions of the largest banks have become increasingly consequential as their systemic importance for the US financial system has grown. Long-term declines in banks' capital positions by the 1970s led US banking regulators to reverse their longstanding aversion to using specific formulas to judge capital adequacy. Regulators have remained cognizant that those formulas can misjudge risks, while also recognizing that bankers and credit rating agencies have misjudged risks as well.

Endnotes

References

American Bankers Association. "The Adequacy of a Bank's Capital Funds." 1954.

Board of Governors of the Federal Reserve System. Annual Report 1942. Available on FRASER.

Board of Governors of the Federal Reserve System. "Appraising the Adequacy of a Bank's Capital." 1956.

Board of Governors of the Federal Reserve System. Federal Reserve Bulletin, August 1960. Available on FRASER.

Board of Governors of the Federal Reserve System. Minutes, December 17, 1952. Available on FRASER.

Board of Governors of the Federal Reserve System. Press Release, April 1, 2020. Available online.

Burns, Arthur. Testimony, First Meeting on the Condition of the Banking System, Hearings Before the Committee on Banking, Housing, and Urban Affairs, United States Senate, March 10 and 11, 1977. Available on FRASER.

Calomiris, Charles and Berry Wilson. "Bank Capital and Portfolio Management: The 1930s 'Capital Crunch' and the Scramble to Shed Risk." The Journal of Business, July 2004. Available online.

Cosgriff, Walter E. Testimony. "Study of Banking Laws, Financial Institutions Act of 1957." Hearings before the Committee on Banking and Currency, United States Senate, Part 2, February 4, 1957. Available on FRASER.

Federal Deposit Insurance Corporation. Annual Report, 1939. Available on FRASER.

Federal Deposit Insurance Corporation. "Volume I: An Examination of the Banking Crises of the 1980s and Early 1990s" in History of the Eighties: Lessons for the Future,1997. Available on FRASER.

Federal Reserve Bank of New York. "A Measure of Minimum Capital Adequacy." 1952.

Ferguson, Roger. "Basel II: A Realist's Perspective." Remarks at the Risk Management Association's Conference on Capital Management, Washington, D.C., April 9, 2003. Available on FRASER.

Hahn, Philip J. The Capital Adequacy of Commercial Banks. 1966.

Holland, Robert C. "Public Policy Issues in U.S. Banking Abroad." Remarks at the 53rd Annual Meeting of the Bankers' Association for Foreign Trade, April 8, 1975. Available on FRASER.

Koch, Christopher, Gary Richardson, and Patrick Van Horn. "Bank Leverage and Regulatory Regimes: Evidence from the Great Depression and Great Recession." American Economic Review: Papers and Proceedings 105(6), 2016: 538-542.

Office of the Comptroller of the Currency. Various Years. Annual Report. Available on FRASER.

Orgler, Yair E. and Benjamin Wolkowitz. Bank Capital. Van Nostrand Reinhold Co., 1976.

Pritchard, Leland J. "A Note on the Relationships of Bank Capital to the Lending Ability of the Commercial Banks." American Economic Review 43(3), 2016: 362-366. Available online.

Robertson, J. L. "Bank Capital Adequacy." Remarks at the Washington Forum for Bank Executives, October 30, 1954. Available on FRASER.

Robinson, Roland I. "The Capital-Deposit Ratio in Banking Supervision." Journal of Political Economy 49(1), February 1941: 41-57. Available online.

Ryon, Sandra L. "History of Bank Capital Adequacy Analysis." FDIC Working Paper 69-4, 1969.

Smith, Tynan. "Past Trend of the Capital Ratio." Summary of Remarks before FDIC Supervising Examiners, Washington, D.C., April 22, 1946. Available on FRASER.

Tarullo, Daniel. Banking on Basel: The Future of International Financial Regulation. Peterson Institute for International Economics, 2008.

Tarullo, Daniel. "Departing Thoughts." Remarks at The Woodrow Wilson School, Princeton University, Princeton, New Jersey, April 4, 2017. Available on FRASER.

Taylor, William. Statement to Congress. Federal Reserve Bulletin, 74(6), June 1988: 376. Available on FRASER.

Tufts, Roger and Paul Moloney. "The History of Supervisory Expectations for Capital Adequacy: Part I (1863-1983)." Office of the Comptroller of the Currency, 2022. Available online.

Published March 8, 2024. Jonathan Rose contributed to this article. Please cite this essay as: Federal Reserve History. "Bank Capital Standards." March 8, 2024. See disclaimer and update policy.

X

X  facebook

facebook

email

email