The Federal Reserve pegged interest rates at a low level during World War II in order to facilitate the financing of government debt and enforced that peg for six years after the war’s end.

Employment Act

President Truman signed the Act in 1946 in the aftermath of WWII

Bretton Woods Created

A new international monetary system was forged in 1944

The Federal Reserve's Interactions with Japanese Americans during WWII

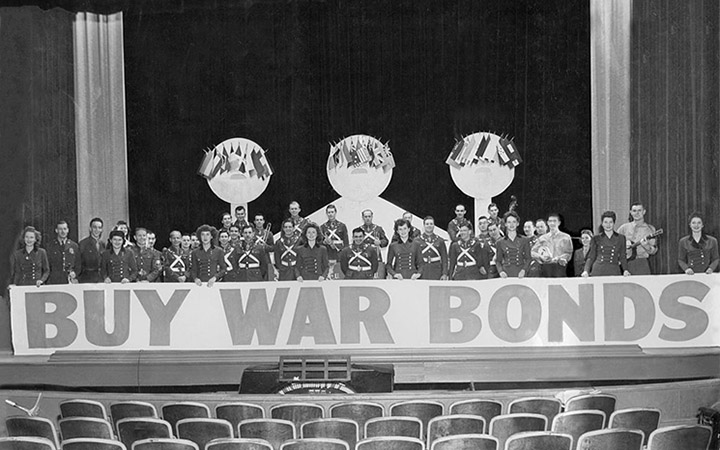

As part of the war effort, the Fed was assigned a duty well outside of its normal activities.

WWII and Its Aftermath

Monetary policy fundamentally changed during the period of 1941 to 1951

The Fed's Role During WWII

The Federal Reserve supported the war effort in several ways