The Federal Reserve's Community Development Function

The Federal Reserve’s Community Development (CD) function promotes economic growth and financial stability for low- and moderate-income (LMI) communities.1 The CD function was added to the Federal Reserve’s responsibilities following the passage of the Community Reinvestment Act (CRA) in 1977, with an initial focus of facilitating compliance of lenders with the Act. Today, Reserve Banks seek to catalyze progress toward economic objectives for underserved communities through a number of tools, including researching what works, sharing information, convening stakeholders, and connecting lenders with places in need.

Origins

In the 1970s, the twelve Federal Reserve Banks began to develop a staff function to facilitate the compliance of Fed-regulated banks with fair lending laws and the CRA. In addition, the CRA required the Federal Reserve and other financial regulators to encourage the financial institutions they regulate to help meet the credit needs of the communities in which they do business. To coordinate and formalize these developing activities, the Board of Governors requested in 1981 that each Reserve Bank appoint a Community Affairs Officer (CAO).2

CAOs were charged with promoting the goals of the CRA, serving as the principal contact for questions about the CRA and Fed procedures, being community liaisons, facilitating partnerships among banks and community groups, and fostering the flow of information on subjects such as community development needs.3 CAOs and related staff were initially housed in the Fed’s supervision and regulation divisions and were known as Community Affairs, but were later renamed to Community Development and established under research or public engagement functions in Reserve Banks.

Evolution

In the early years of the CD function, Reserve Banks responded to lenders’ requests to understand how to comply with the CRA and by community groups to understand how the statute could be used to effectively further the economic objectives of their communities. Reserve Banks provided educational and training services to each of these groups and helped facilitate connections.4

Over time, banks and community groups acquired their own significant expertise with and understanding of the CRA, and community groups increasingly engaged directly with banks. Reserve Bank community development activities have evolved in tandem, taking on a wider range of approaches to promoting effective community development.

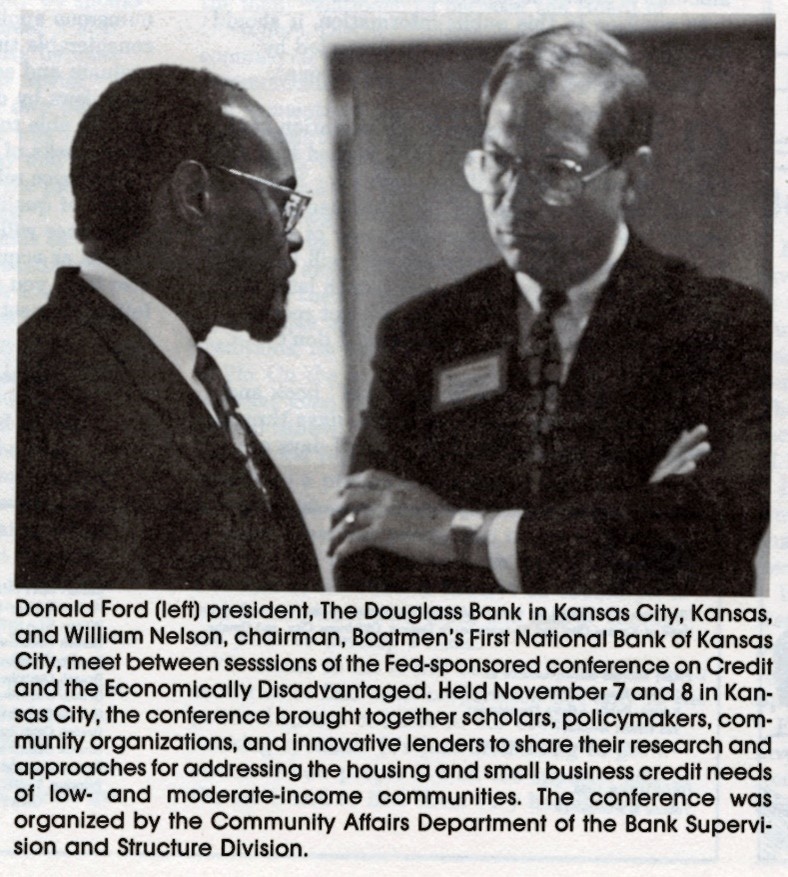

One principle that guided the Fed’s efforts in the 1980s and 1990s was that overcoming barriers to community development was sometimes a matter of bringing together lenders and community groups and facilitating partnerships. "We Bring People Together" was the title of a brochure issued by the Kansas City Fed’s CD group, highlighting the Fed’s power to convene through conferences, training programs, and other events. In 1998, for example, the Federal Reserve System sponsored or cosponsored 280 conferences attended by more than 12,900 people and conducted more than 1,600 outreach meetings.5

Through these convenings, the Federal Reserve played a role in facilitating relationships between banks and community groups after the passage of the CRA.6 Community groups continued to urge lenders to invest in their communities and, empowered by the CRA, lodged complaints when they saw banks as inadequately responsive to community needs. Federal Reserve convenings sometimes resulted in compromises between banks and community groups. For example, a compromise might include a bank’s agreement to appoint a special loan officer or loosen strict lending requirements to ensure that credit was available to the entirety of its service area, including LMI communities as encouraged under the CRA.

Reserve Banks also served as a facilitator in response to the wave of mergers in the banking industry in the 1980s and 1990s. In one precedent-setting case, the Chicago Fed held public hearings in 1998 on the merger between the First National Bank of Chicago and its acquirer, Banc One. Chicago-area community activists such as Rev. Jesse Jackson and Gale Cincotta pushed the two banks to make specific commitments for community development and to serve their communities as required by the CRA.7

As the CRA became law of the land, banks gave more attention to the needs of LMI communities and increasingly sought information on impactful strategies and opportunities. As a result, research and information sharing have become correspondingly important aspects of the Fed’s CD activities. As Board Governor Ned Gramlich observed, "By serving as a neutral information broker, the Federal Reserve has helped to foster relationships among market participants and has promoted the development of new and innovative funding arrangements."8 To put it another way, Philadelphia Fed President Harker once summarized CD as promoting "research-informed practice and practice-informed research."9

To share information on CD opportunities and strategies, Reserve Banks began producing newsletters during the 1980s and 1990s. One example is the Federal Reserve Bank of Kansas City’s Community Reinvestment newsletter, aimed at "helping readers find creative solutions to community issues." Other informational products have included community profiles, needs assessments, and databases of community contacts and ongoing programs or investments. In addition, Reserve Bank activities have increasingly integrated applied research and data analysis to promote evidence-based methods for community development, drawing on research conducted within the Fed and externally. This evolution of the Fed’s CD activities parallels changes in the practice of CD more broadly, placing increasing emphasis on data and analytics to identify opportunities and evaluate costs and benefits. "Good data—and good data analysis—are critical in the work of community organizations" observed Federal Reserve Board Chairman Ben Bernanke in 2003.10

Finally, in addition to promoting access to credit, CD activities have also supported other Federal Reserve mandates, including understanding economic developments relevant for monetary, financial stability, supervisory, and regulatory policies and the impacts of those policies on LMI communities.

Major Initiatives

The Federal Reserve System’s CD efforts are decentralized. The regional structure of the twelve Reserve Banks allows them to respond to the varied needs of America’s diverse communities, while the Board offers a national perspective and provides oversight and guidance. The focus of CD efforts has varied over time and space, reflecting changes in the financial sector, regulations, and community needs.

One perennial focus of CD activities has been promoting expanded access to mortgage financing and affordable housing to promote economic mobility. One technique facilitated by Reserve Banks has been the formation of multi-bank lending consortia. Such consortia provide investment opportunities to smaller banks that may not have the specialized knowledge necessary for loans of these kinds. In addition, by pooling together funds, banks can finance larger and potentially more impactful projects. The San Francisco Fed, for example, played a role in convening stakeholders in the formation of the California Community Reinvestment Corporation, a multi-bank lending consortium in 1989, in partnership with the San Francisco Development Fund.11 That consortium eventually served as a model that was replicated in other western states.12 Another approach to convening stakeholders was developed first by the Cleveland Fed: The Cleveland Residential Housing and Mortgage Credit Project13 focused on achieving consensus across a wide array of real estate market participants—lenders, appraisers, real estate agents, insurers, and others—on a set of steps to reduce disparities in mortgage lending programs, including professional training programs.

While urban housing finance needs figured prominently in the push for the CRA, many rural LMI communities have also been the focus of CD efforts. Such areas are often characterized by relatively few banking facilities, and lenders often face a lack of data and experience in understanding rural financing needs. To address the information gap, Reserve Banks have published profiles of rural areas, highlighting in particular areas such as the Lower Mississippi Delta, Appalachia, and the colonias region on the border with Mexico.14 Rural economic development priorities also include digital inclusion, as many rural areas lag behind in access to high-speed internet. The Dallas Fed produced a report in 2016 about opportunities for banks to help close the digital divide while also meeting their CRA obligations, and in 2022 several Reserve Banks held workshops to help states plan for the use of federal funds in making investments in digital inclusion.15

Several Federal Reserve Districts encompass Native American communities, which have been the focus of Reserve Bank CD efforts since the early 1990s. This work was in part prompted by the denial by the Federal Reserve of a merger between two banks in Montana in 1991. The banks had a poor record of serving the needs of the Northern Cheyenne community, as noted by a community group, Native Action, that protested the merger.16 The Minneapolis Fed's Center for Indian Country Development has developed resources to address some of the underlying barriers to the flow of credit in Indian Country.17 Several other Reserve Banks have also developed programs to provide information and facilitate bank and other investments in Indian Country.

Reserve Banks have acted independently in developing these initiatives, but over time have also become more coordinated and strategic in how they work together as a System. Reserve Banks collaborate to contribute to national efforts, such as the Federal Reserve's Community Development Research Conference and the Federal Reserve System's Small Business Credit Survey, while continuing to engage in programs that are responsive to their individual regions.18 They have adapted projects initially developed by other Reserve Banks, such as the Boston Fed’s Working Cities Challenge, a grant competition designed to identify and support community development in post-industrial cities, and the Kansas City Fed’s Investment Connection initiative, a forum for matching CRA-eligible proposals from community organizations with funding organizations.19 And they have coordinated initiatives that organically grew from regional to national in scope, such as the Philadelphia Fed’s Reinventing our Communities racial equity training program and the Cleveland Fed’s Policy Summit, which began in the early 2000s to share information on best practices in community development.

Finally, some pressing national issues have prompted coordinated CD initiatives across the Federal Reserve System. Prominent examples include the following:

- The foreclosure crisis beginning in 2007 led to coordinated efforts across the Fed System to help stem the crisis in LMI communities. CD programs were a key source of information about the unfolding crisis. Research efforts included the Mortgage Outreach and Research Efforts (MORE) program20 and the study of the incidents and underlying causes of foreclosures and of policies designed to limit the spillover effects of abandoned and foreclosed properties.21 These efforts also involved outreach, including partnership with NeighborWorks America, public service announcements in movie theaters that warned of foreclosure-related scams, and local initiatives such as a foreclosure prevention workshop hosted by the Boston Fed and the New England Patriots Charitable Foundation at Gillette Stadium in 2008.22

- Persistent unemployment after the 2007-2009 recession helped motivate a widespread focus across the Federal Reserve System on research and outreach related to workforce development and human capital. Over the past decade, myriad Fed-sponsored publications and convenings on these topics, often coordinated across Reserve Banks, have also highlighted the increased importance of applied research in community development.23

- The COVID-19 pandemic also prompted a nationally coordinated response. Research efforts included a set of four surveys to understand how LMI communities and the entities that serve them were affected by the pandemic.24 The System also conducted outreach to advise and encourage participation of community development financial institutions and minority depository institutions in the Paycheck Protection Program Lending Facility and Main Street Lending Program.25

A 2009 public service announcement from the Board of Governors providing tips and information for avoiding mortgage foreclosure rescue scams

Conclusion

The approach of the CD function within the Federal Reserve has evolved over time, in line with changes in the financial system and as Reserve Banks have embraced new approaches. The CD function initially focused on facilitating the compliance of lenders with the CRA and put emphasis on convening stakeholders and connecting lenders with community groups. Over time, Reserve Banks have also increasingly integrated applied research into their activities, sharing evidence-based information on successful community development opportunities and strategies to support innovation in financing efforts that expand local economic development in LMI communities.

Endnotes

- 1 See the Fed Communities website for an overview of current community development activities.

- 2 Board of Governors of the Federal Reserve System. 68th Annual Report, 1981. April 15, 1982.

- 3 Board of Governors of the Federal Reserve System. 71st Annual Report, 1984. June 21, 1985; Federal Reserve Bank of New York. "Community Reinvestment Act." Circular no. 9647, February 3, 1984.

- 4 Daniel K. Tarullo. "The Community Affairs Function at the Federal Reserve." April 25, 2009.

- 5 Board of Governors of the Federal Reserve System, 85th Annual Report, 1998. May 1999: 218.

- 6 Federal Reserve Bank of St. Louis. Building Bridges to Community Development: 1993 Annual Report. 1994.

- 7 Melissa Wahl. "Banks target of merger protest: Supporters also weigh in at hearing." Chicago Tribune, August 14, 1998.

- 8 Edward M. Gramlich. "Remarks at the Consumer Bankers' Association Community Reinvestment Act Conference." April 8, 2002.

- 9 Patrick T. Harker. "Unrealized Gains: Investing in Our Region’s Economic and Human Capital Potential." Speech at "Capital for Communities: Pay for Success Financing," Federal Reserve Bank of Philadelphia, November 4, 2015.

- 10 Ben S. Bernanke. "Soft Hearts and Hard Data." Remarks before the 2003 Community Development Policy Summit, June 11, 2003.

- 11 Robert T. Parry. "Community Investment in the 1990s: Partnership and Progress." Remarks at Partnership and Progress: Community Investment Conference, San Diego, California, June 1, 1989.

- 12 Federal Reserve Bank of San Francisco. 1993 Annual Report.

- 13 White House. Cleveland Residential Housing and Mortgage Credit Project. Circa 1998. Archived from the original by the National Archives and Records Administration; Federal Reserve Bank of Cleveland. "Local Solutions, Lasting Change: The Greater Cleveland Residential Housing and Mortgage Credit Project." 1996 Annual Report.

- 14 Federal Reserve Bank of Dallas. Banking and Community Perspectives. Third Quarter 1999; Federal Reserve Bank of Dallas. Las Colonias in the 21st Century. April 2015; Michelle Park Lazette. "On the Ground in Eastern Kentucky." Federal Reserve Bank of Cleveland, September 2017.

- 15 Federal Reserve Bank of Dallas. Closing the Digital Divide: A Framework for Meeting CRA Obligations. July 2016; Federal Reserve Bank of Kansas City. "New funding better enabling states, organizations to bridge the digital divide." Ten magazine, October 13, 2022.

- 16 Associated Press. "Fed Rejects Bank Merger Based on Failure to Serve Indian Needs." October 10, 1991.

- 17 Narayana Kocherlakota. "Persistent Poverty on Indian Reservations." Speech at the Federal Reserve System Community Development Research Conference, 2015; Board of Governors of the Federal Reserve System, Annual Reports of 1996 and 1998.

- 18 "Strong Foundations: The Economic Futures of Kids and Communities." Federal Reserve System Community Development Research Conference, Washington, D.C., March 23-24, 2017.

- 19 See Federal Reserve Bank of Boston. "Initiatives." and Federal Reserve Bank of Kansas City. "Investment Connection."

- 20 Federal Reserve System. Addressing the Impacts of the Foreclosure Crisis: Federal Reserve Mortgage Outreach and Research Efforts. 2010.

- 21 Federal Reserve Banks of Boston and Cleveland and the Federal Reserve Board. REO and Vacant Properties: Strategies for Neighborhood Stabilization. 2010.

- 22 Federal Reserve Bank of Boston. "Gillette Stadium to Host Foreclosure Prevention Workshop for Struggling Homeowners." News Release, July 17, 2008.

- 23 For example, see Board of Governors of the Federal Reserve System, "A Perspective from Main Street: Long-Term Unemployment and Workforce Development." 2012; As another example, see Investing in America’s Workforce from the Federal Reserve System and its partners.

- 24 Fed Communities. "Perspectives from Main Street: COVID-19’s continued impact on low- to moderate-income communities." November 5, 2020.

- 25 Board of Governors of the Federal Reserve. "Consumer and Community Affairs." Annual Report 2020. August 26, 2021

Written as of May 8, 2023. Jonathan Rose contributed to this article. Please cite this essay as: Federal Reserve History. "The Federal Reserve's Community Development Function." May 8, 2023. See disclaimer and update policy.